PVTIME – In 2023, despite unstable supply chains, sharp drops in raw material prices, and low profits, the solar power industry in China continued to develop.

China was the major driving force behind the world’s rapid expansion of renewable power generation capacity in 2023, which grew by 50% to 510GW, according to the International Energy Agency. A new report shows that renewable energy capacity grew rapidly worldwide last year, with China driving most of the growth. The report indicates that green energy was produced more rapidly than in previous decades. China was responsible for almost 90% of the global upward forecast revision, mainly due to solar photovoltaic energy. The statement highlights that the country’s manufacturing capabilities for solar photovoltaic modules have reduced local prices by almost 50% between January and December 2023, making both utility-scale and distributed solar PV projects more economically attractive.

China’s expansion in PV manufacturing has resulted in a more than twofold increase in solar capacity by 2023. It is crucial to evaluate the performance and development of manufacturers in this industry.

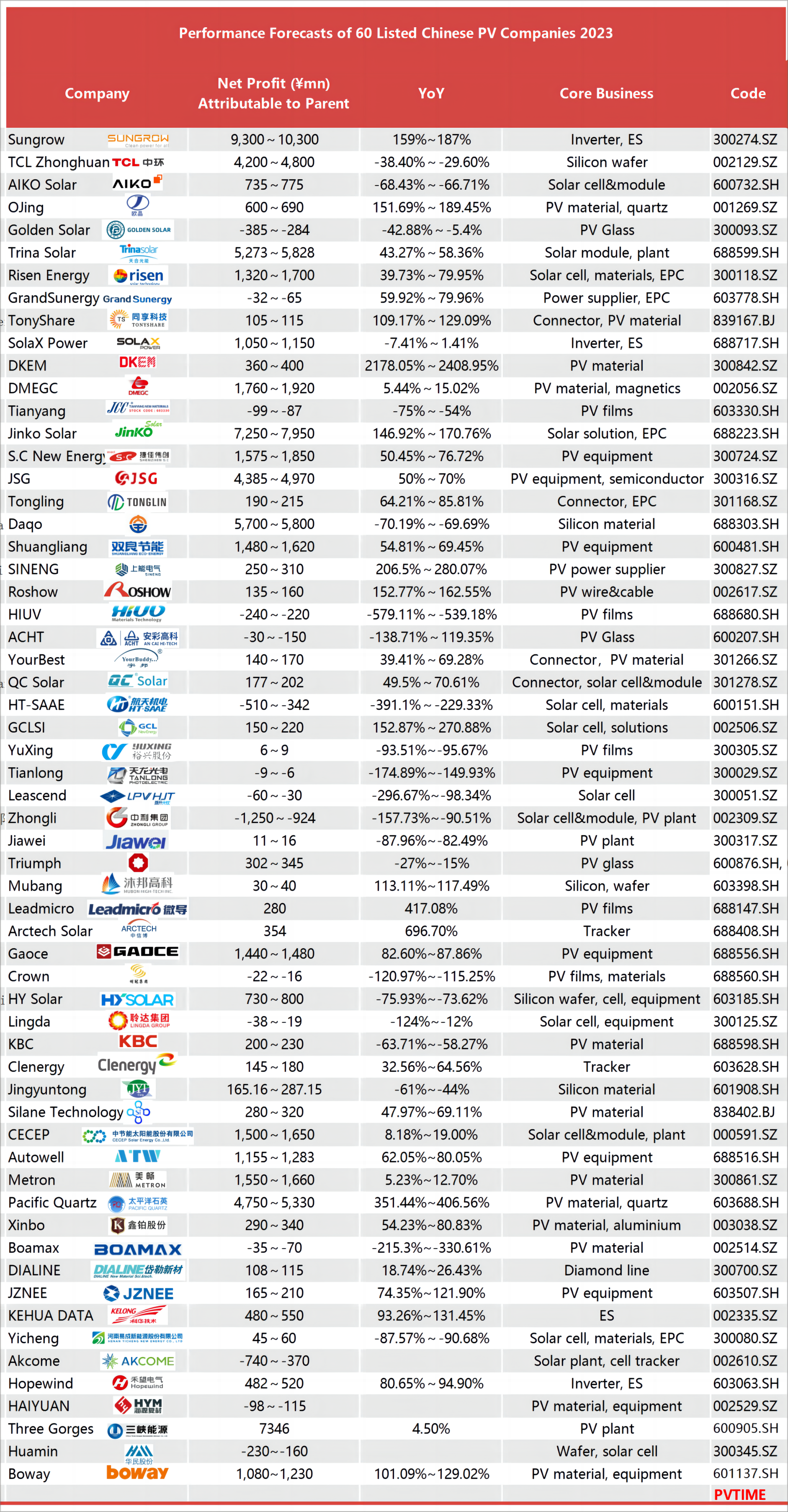

Between January and February 2024, almost sixty Chinese photovoltaic listed companies disclosed their performance predictions for the 2023 fiscal year, revealing a polarisation trend. Some enterprises are expected to turn losses into profits, with a net profit increase of more than 20 times in extreme cases. However, other enterprises are operating poorly, with a net loss of more than 1 billion yuan, raising the question of whether a new round of reshuffling is imminent.

Note: The above information provides preliminary accounting data. Specific and accurate financial data will be disclosed by the respective companies based on their audited 2023 annual reports.

Out of the 60 photovoltaic companies that released performance forecasts, 34 reported an increase in net profit attributable to parent, accounting for approximately 56.67% of the total.

The top-performing PV companies are Sungrow, Jinko Solar, Trina, Daqo, Pacific Quartz, Jingsheng, TCL Zhonghuan, and Three Gorges, each with a net profit attributable to the parent company of more than 4 billion yuan in 2023.

The 13 companies with a year-over-year (YoY) increase of over 100% respectively are DKEM, Arctech Solar, Pacific Quartz, Leadmicro, Sungrow, GCLSI, SINENG, OJing, Jinko Solar, Roshow, Mubang, TonyShare, and Boway.

Out of these companies, 10 are manufacturers of photovoltaic materials, such as PV films, quartz, alloy, trackers, and related materials, while 7 are involved in producing solar cells, modules, or equipment.

In general, top Chinese photovoltaic manufacturers have a high risk tolerance and are expected to achieve significant net profits in 2023. Sungrow, the world’s leading supplier of PV inverters and energy storage systems, is projected to generate revenue of 71 to 76 billion yuan (9.869 to 10.564 billion US dollars), representing a YoY increase of 76%-89%. The expected net profit attributable to parent company is between 9.3 billion and 10.3 billion yuan (1.2927 billion and 1.4317 billion US dollars), representing a YoY increase of 159% to 187%. The estimated net profit after deductions is expected to be between 9.15 and 10.15 billion yuan (1.272 billion and 1.411 billion US dollars), reflecting a YoY increase of 170% to 200%. The increase in performance is primarily attributed to Sungrow’s rapid growth in developing and selling photovoltaic inverters, energy storage systems, and investing in renewable energy projects. Additionally, Sungrow’s financial results were positively impacted by reduced shipping costs and a favourable foreign exchange rate during the first half of the year, among other factors.

Zhejiang Jingsheng Mechanical & Electrical Co., Ltd. (JSG, 300316.SZ), a Chinese high-tech company that specializes in producing high-end semiconductor equipment and LED substrate materials, expects a net profit attributable to the parent company of between 4.385 billion and 4.970 billion yuan (611,707,500 and 693,315,000 US dollars), up 50% to 70%. The net profit after tax is expected to be between 4.12 billion and 4.705 billion yuan (574,740,000 and 656,347,500 US dollars), up 50.36% to 71.70%. In 2023, JSG optimised its product structure and promoted its PV equipment and material business. The company’s performance has been positively impacted by the innovative equipment for PV production, increased production capacity for quartz crucibles, diamond wire, silicon carbide, and related advanced materials.

Qingdao Gaoce Technology Co., Ltd. (Gaoce, 688556.SH) is expected to achieve a net profit attributable to the parent company of 1.44 billion to 1.48 billion yuan, representing an increase of 82.60% to 87.67%. Gaoce specialises in researching, developing, producing, and selling cutting equipment for hard and brittle materials and cutting tools. Its net profit after deductions is expected to be 1.40 billion to 1.46 billion yuan, an increase of 86.61% to 94.61%. Gaoce attributed the increase in performance to a significant rise in photovoltaic equipment orders in 2023. Production capacity and shipments of diamond wire also saw a dramatic increase with full production and sales. Additionally, the wafer cutting and processing services business experienced an increase in production capacity in 2023. Meanwhile, its sales of equipment and consumables for semiconductors, sapphire, magnetic materials, silicon carbide, and other innovative materials grew steadily. This has also contributed to the overall improvement in performance.

In recent years, many profitable Chinese PV companies have been promoting an integrated layout. Chinese PV enterprises with a well-integrated layout are better equipped to handle market pressure.

Trina Solar (688599.SH), a global provider of solar PV and smart energy solutions, forecasts a net profit attributable to parent of 5.27 billion yuan to 5.83 billion yuan in 2023, representing a YoY increase of 43.27% to 58.36%. The expected deducted net profit is 5.47 billion yuan to 6.04 billion yuan, a YoY increase of 57.83% to 74.44%.

Both GCL System Integration Technology Co., Ltd. (GCLSI, 002506.SZ) and Risen Energy Co., Ltd. (Risen Energy, 300118.SZ) are involved in the layout of integrated PV solutions.

GCLSI, a leading provider of renewable energy services, is expected to achieve revenue of 15.5 billion to 17.0 billion yuan, an increase of 85.6% to 109% YoY. Its net profit attributable to the parent company is expected to be between 150 million and 220 million yuan, an increase of 152.9% to 270.9% YoY. The performance increase was primarily due to the leading shipments of modules with large production and sales volume in 2023. Specifically, the first phase of the module production base in Hefei City, China, achieved a production capacity of 15GW of modules per year. Its Funing base with a capacity of 12GW of high-efficiency modules was put into operation as planned in 2023, both of which increased the production capacity of large-size, high-efficiency solar modules. Simultaneously, the initial phase of the solar cell production facility in Wuhu City, China commenced operations with exceptional product yields. Additionally, sales channels were expanded resulting in almost a doubling of orders. Several orders were received from large enterprises, while the products were promoted in the international market. Moreover, the concentrated solar system business and EPC contracts were augmented. Its energy storage business in both domestic and overseas markets were promoted. The company effectively managed costs resulting in improved performance in 2023 compared to the previous year.

Risen Energy Co., Ltd. (Risen Energy, 300118.SZ), a company engaged in researching, developing, manufacturing, and selling grid-connected PV power generation systems, has disclosed that its net profit attributable to the parent company in 2023 is expected to be between 1.32 billion and 1.7 billion yuan, an increase of 39.73% to 79.95% YoY. After deducting non-recurring gains and losses, Risen Energy projects a net profit of between 1.44 billion and 1.85 billion yuan, representing a YoY increase of 40.39% to 80.37%. The company attributed this growth to the gradual increase in production capacity of solar cells and modules at its overseas bases, resulting in increased module sales and a positive impact on performance. Furthermore, the recently established manufacturing facilities have commenced operations and produced high-efficiency HJT cells and modules. Additionally, the energy storage and residential solar divisions have expanded, leading to a significant increase in profits.

Some Chinese PV companies with positive profits have optimised their product structure and engaged in the development and production of n-type solar cells and modules.

For instance, Jinko Solar Co., Ltd. (Jinko Solar, 688223.SH), one of the world’s largest and most innovative solar module manufacturers, expects its net profit attributable parent to increase by 146.92% to 170.76% YoY, reaching 7.25 billion to 7.95 billion yuan in 2023. It is mentioned that there is an expectation of a significant increase in operating results in 2023 through a substantial increase in the production and sales of n-type modules globally, leveraging the company’s leading technology for n-type TOPCon products, taking advantage of global channel management and an integrated layout plan.

Similarly, Trina Solar benefited from increased production capacity of n-type solar products. Sales of its TOPCon module and high-power 210 series of PV products increased significantly in 2023. And the increase in production of n-type wafers will further reduce costs for solar cells and modules.

However, some companies have not benefited from their newly added n-type production lines.

Shanghai Aiko Solar Energy Co., Ltd. (AIKO, 600732.SH), a company that specializes in all-back-contact (ABC) solar cells, expects its net profit attributable to parent in 2023 to range from 735 million yuan to 775 million yuan. This represents a YoY decline of 66.71% to 68.43%. Its net profit after deduction is expected to be between 300 million yuan and 340 million yuan, which is a YoY decrease of 84.30% to 86.14%. AIKO reported an increase in expenses due to investments in new facilities and operations, as well as costs associated with establishing a new sales network and marketing for ABC products.

Zhejiang Akcome New Energy Technology Co. (Akcome, 002610.SZ), a provider of full lifecycle operation services for high-efficiency solar cells, modules and power plants, is currently developing HJT (heterojunction) products. The company predicts a net profit loss of between 370 million yuan and 740 million yuan, a YoY decrease. However, Akcome is confident that it will secure a leading position in the industry by continuously upgrading its production lines and increasing the manufacture of high-efficiency HJT solar cells and modules.

Out of the 60 photovoltaic enterprises listed, 26 experienced a decline in profits, accounting for 43.33%. Among these, 14 reported losses.

Jiangsu Zhongli Group Co., Ltd. (Zhongli, 002309.SZ), the parent company of module maker Talesun Solar, reported increased losses, expected to be between -924 million to -12.5 million yuan. Zhongli stated that it was focused on pre-restructuring in 2023 due to working capital constraints, low production capacity, and limited orders.

Although silicon material producers and wafer makers had a successful year in 2022 with high revenue and profit, their performance declined in 2023.

TCL Zhonghuan, the leading manufacturer of silicon wafers, predicts a net profit attributable to parent of between 4.2 billion yuan and 4.8 billion yuan for 2023, which represents a YoY decline of 29.6% to 38.4%. The deducted net profit is expected to be between 3.1 billion yuan and 3.6 billion yuan, a YoY decline of 44.47% to 52.18%. In the first three quarters of 2023, the company’s net profit increased by 23.75% YoY, reaching 6.188 billion yuan. In 2022, the net profit increased by 69.21% YoY.

Daqo, a major silicon provider in China, expects a net profit attributable to parent of 5.7 to 5.8 billion yuan in 2023, which is a decrease of 69.67% to 70.19% YoY. The net profit after deduction is expected to be 5.72 to 5.82 billion yuan, down 69.61% to 70.13% YoY. However, in the first three quarters of 2023, Daqo reported a net profit of 5.115 billion yuan. In 2022, Daqo achieved a significant increase of 234.06% in net profit.

Both companies attribute the net profit reduction to the sharp decline in silicon prices in the photovoltaic industry caused by overcapacity.

Several new vendors, mainly in the silicon wafer industry, have released disappointing earnings projections for 2023. HOYUAN Green Energy Co., Ltd. (HY Solar, 603185.SH) anticipates a net profit attributable to the parent company of between 730 million yuan and 800 million yuan, representing a YoY decrease of 73.62% to 75.93%. Beijing Jingyuntong Technology Co., Ltd. (Jingyuntong, 601908.SH) anticipates a decrease in net profit attributable to the parent company of between 44.00% to 61.00%, with a range of 165 million yuan to 237 million yuan. Hunan Huamin Holdings Co., Ltd. (Huamin, 300345.SZ) expects a net loss of between 160 million yuan to 230 million yuan, which is an increase in loss compared to the 34.886 million yuan loss in 2022.

The decrease in profit was primarily caused by the significant drop in prices across the PV industry supply chain in 2023, resulting from expansion and increased competition. Despite cost control and quality maintenance, HY Solar’s profit from their core product, monocrystalline silicon wafers, also decreased due to the price drop. Additionally, new facilities for producing silicon material, solar cells, and modules gradually became operational in the second half of 2023. Continuous investment is required and may affect performance. The newly added capacity is expected to bring profit once fully operational in the future with reasonable adjustments.

Although the preliminary 2023 financial data of other major Chinese PV companies such as LONGi, CSI Solar, Tongwei, Suntech, JA Solar, Chint/Astronergy, etc. have not been released, the overall performance forecasts of Chinese listed PV companies are not as positive as in 2022. The continued downward trend in prices throughout the industrial chain seems to have further impacted their performance in 2024.

The silicon prices have recovered in recent weeks, they still remain low. And its influence on the entire industrial chain cannot be neglected. POWERCHINA, an integrated construction group that provides investment, planning, design, engineering, equipment manufacturing, and operation management for clean and low-carbon energy, water resources, environmental construction, and infrastructure, has published tender notices for the procurement of PV products for 2024. The required installed capacity is 42GW. In January 2024, the lowest price it received for p-type photovoltaic modules was 0.806 yuan/W, while the lowest offer for n-type solar modules was 0.87 yuan/W, both of which have hit a record low.

For the foreseeable future, overcapacity and declining prices will continue to be major challenges for the Chinese PV industry.

Chinese PV companies with advanced photovoltaic production capabilities will maintain their competitive edge, while small and medium-sized producers without technological advantages may struggle to expand rapidly due to insufficient capital and may be forced to exit the industry. In essence, the victors of this game will be those with advanced technology, extensive production capacity, and substantial capital that can consistently lower costs and enhance efficiency.

After the defeated parties have departed, Chinese photovoltaic manufacturers will redirect their attention from low prices to innovative technology and efficient management systems. This will facilitate the growth of solar power and contribute to the objective of reducing carbon emissions.

Scan the QR code to follow PVTIME official account on Wechat for latest news on PV+ES