PVTIME – The H1 2023 Photovoltaic Development Review and Outlook in H2 Forum was held on 20 July 2023. At the meeting, Wang Bohua, Honorary Chairman of CPIA, presented a detailed review of the photovoltaic industry in H1 2023 and gave CPIA’s outlook on the development situation of the photovoltaic industry in H2 2023.

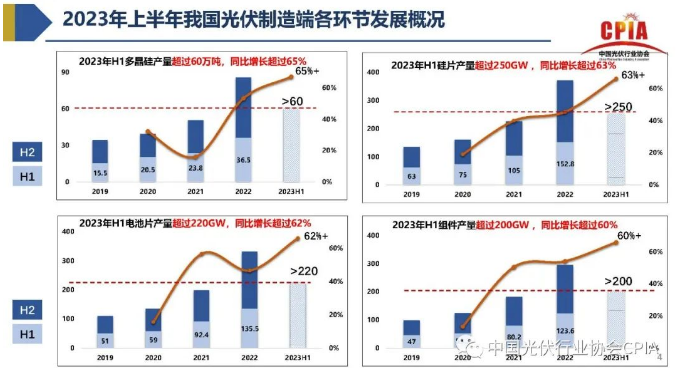

In the first half of 2023, the year-on-year growth of polysilicon, silicon wafer, cell and module production volume in China all exceeded 60%. Specifically, polysilicon production exceeded 600,000MT, up more than 65% year-on-year, and silicon wafer production exceeded 250GW, up more than 63% year-on-year. Cell production exceeded 220GW, up more than 62% year on year, and module production exceeded 200GW, up more than 60% year on year.

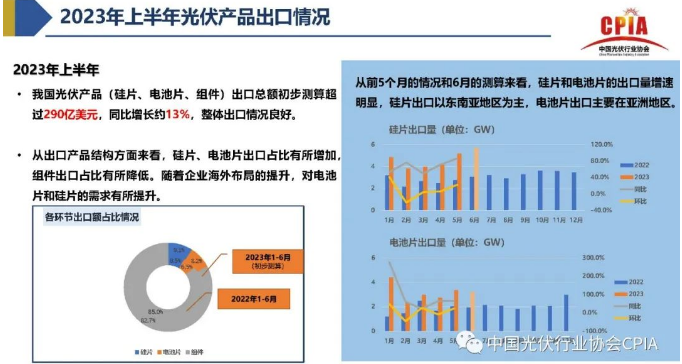

In addition, China’s total exports of photovoltaic products (silicon wafers, cells and modules) in the first half of 2023 are preliminarily estimated to exceed US$29 billion, an increase of about 13% year-on-year.

The share of silicon wafer and cell exports has increased, while the share of module exports has decreased. Specifically, the demand for solar cells and wafers showed an impressive year-on-year increase, especially in June, due to the improvement of overseas layout of PV enterprises. Southeast Asia was the main demand for silicon wafer exports, while Asia mainly demanded solar cell exports, and Europe was the main and largest module export market.

The growth in module export volume to Africa was evident in H1 2023, as the value of module exports to South Africa more than tripled year-on-year. However, as the PV installation volume in the African market is lower than the imported module volume, it is difficult for China to maintain a high proportion of export growth in H2. Similarly, China’s PV export to Europe is likely to slow down due to the complicated installation application in the residential PV market and the shortage of labour, high inventory level of distributors, coupled with issues related to land requirement, grid consumption and so on.

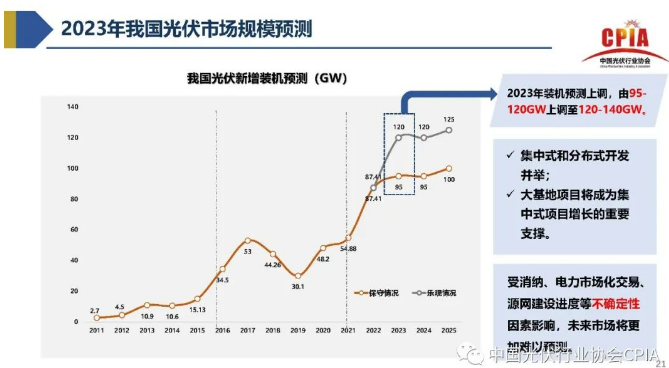

Mr Wang pointed out that the expected installed capacity of solar power has been promoted from 95GW-120GW to 120GW-140GW in 2023. Meanwhile, according to CPIA, the global PV new installation in 2023 is expected to be 305-350GW, which was predicted to be 280-330GW in the conference held in February 2023.

What is more, prices in the PV supply chain in China have experienced a rapid decline since the beginning of the year to date, falling by more than 78% compared to last year’s peak price. The rapid and sustained price decline in H1 may lead customers to expect further price reductions in H2.

However, Mr Wang pointed out that the market will be more unpredictable in the future due to uncertainties such as the volume of electricity consumption, electricity trading and the progress of network construction.