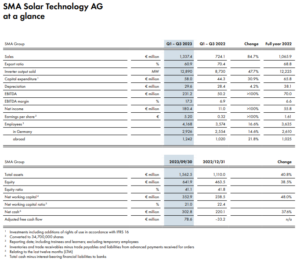

PVTIME – The SMA Solar Technology AG Group, a leading global expert in system technology, recently disclosed its Q3 2023 financial results along with its full-year performance expectations. During the first nine months of 2023, sales surged by 84.7% to €1,337.4 million as compared to the same period in 2022.

Q1-Q3 performance at a glance:

Sales increase to €1,337.4 million (Q1-Q3 2022: €724.1 million)

EBITDA of €231.2 million (Q1-Q3 2022: €50.2 million)

Improved profitability in all business segments

Continued high orders backlog of €2.0 billion

Free cash flow of €78.6 million, net cash increased to €302.8 million

From January to September 2023, the SMA Group successfully sold PV inverters with an accumulated power of 12,890 MW, a significant increase from 8,730 MW in Q1–Q3 2022. Sales rose significantly by 84.7% to €1,337.4 million in the reporting period (Q1–Q3 2022: €724.1 million). The significant year-on-year rise in sales demonstrates the high demand for SMA products and the enhanced delivery conditions since the start of the year.

All three segments reported an increase in sales, leading to positive EBIT 1 figures across the board. The SMA Group has a strong international foothold and conducts business in all relevant regions. Specifically, during the reporting period, SMA generated 71.9% of external sales across Europe, the Middle East, and Africa (EMEA), 21.9% in the North and South American regions, and 6.2% in the Asia-Pacific region (APAC). This marks a change from Q1-Q3 2022, where EMEA represented 60.8%, Americas represented 25.6%, and APAC represented 13.6% of external sales before sales deductions. During the reporting period, the Large Scale & Project Solutions sector was responsible for the highest sales with a contribution of 38.6% (Q1–Q3 2022: 41.9%). The Home Solutions segment made up 36.4% of the SMA Group’s sales, with the Commercial & Industrial Solutions segment contributing 25.0% (Q1–Q3 2022: 31.7% Home Solutions, 26.4% Commercial & Industrial Solutions). The SMA Group currently has an extensive order backlog of €2,020.7 million as of 30 September 2023 (30 September 2022: €1,712.8 million). Of this amount, €1,647.0 million is allocated to the product business (30 September 2022: €1,288.9 million). Consequently, the backlog of orders related to products has only slightly decreased in comparison to 31 December 2022 (€1,700.7 million), despite the substantial increase in sales. Similarly, €373.7 million of the order backlog is assigned to the service business (30 September 2022: €423.9 million). Most of this proportion will be executed in the next five to ten years.

External sales in the Home Solutions sector grew by 112.0% to €486.2 million during the first nine months of 2023 (Q1-Q3 2022: €229.3 million). Home Solutions segment sales accounted for 36.4% of SMA Group’s overall sales (Q1-Q3 2022: 31.7%). Gross sales were dominated by EMEA region, making up 96.4% (Q1-Q3 2022: 85.0%), while Americas region contributed 2.3% (Q1-Q3 2022: 9.4%) and APAC region added 1.2% (Q1-Q3 2022: 5.6%).

Operating profit before interest and tax (EBIT) for the Home Solutions sector increased significantly to €136.9 million due to increased sales (Q1–Q3 2022: €35.4 million). Similar to last year, the sector’s earnings contain a small positive impact in a low seven-digit figure arising from the recognition of revised product quality standards as part of reassessing warranty provisions for previously sold products, which is a routine reporting practice at the end of each period. Overall, this provision is growing as a result of increased sales volume. Regarding external sales, the EBIT margin was 28.2% (Q1-Q3 2022: 15.4%).

The Management Board of the SMA Group has confirmed its forecast for sales and earnings for the financial year 2023, which are expected to be between €1.8 and 1.9 billion (2022: €1.7 to 1.85 billion), with EBITDA ranging from €285 to 325 million (2022: €230 to 270 million).

It also foresees a rise in newly installed PV power to about 327 GW to 335 GW globally by 2023 (212 GW in 2022). The increase is expected to be triggered by all regions. The Board approximates a surge of almost 37% in global investments towards system technology for traditional photovoltaic applications. Investments in system technology for storage applications (excluding investments in batteries) are projected to increase by roughly €700 million to 800 million from the previous year. As a result, the SMA Managing Board anticipates investments in PV system technology (including system technology for storage systems) to total about €14.2 billion to 15.8 billion in 2023 (2022: €10.9 billion).

Scan the QR code to follow PVTIME official account on Wechat for latest news on PV+ES

Scan the QR code to follow PVTIME official account on Wechat for latest news on PV+ES