Canadian Solar Reports Q3 2023 Results

PVTIME – On 14 November 2023, Canadian Solar Inc. (Canadian Solar) (NASDAQ: CSIQ) announced its financial results for the third quarter ended September 30, 2023.

Third Quarter Highlights:

39% increase in solar module shipments year-on-year to 8.3 GW.

Net revenues of$1.85 billion, with a 16.7% gross margin, and net income attributable to Canadian Solar of $0.32 per diluted share.

$2.6 billione-STORAGE contracted backlog, as of 14 November, 2023, of which approximately half are expected deliveries for 2024 that are likely to be significantly gross and net margin accretive helped by the favourable cost environment.

Recurrent Energy expanded its total development pipeline to 26 GWp of solar and 55 GWh of battery energy storage, as of 30 September 2023.

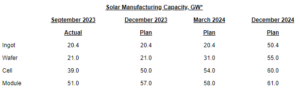

Moreover, CSI Solar shipped 8.3 GW of solar modules to over 70 countries in Q3 2023. The leading five markets by shipments were China, the United States, Brazil, Spain, and Germany. CSI Solar has outlined their updated targets for expanding manufacturing capacity below.

Dr.Shawn Qu, Chairman and CEO, commented, “We delivered solid profitability in the third quarter of 2023 with continued progress on our capacity diversification, despite lower-than-expected market demand growth due to the higher interest rate environment driving higher inventories in certain markets. We significantly ramped up our capacity in the latest N-type TOPCon cell technology, which now accounts for half of our total cell capacity and is expected to reach 60% by the end of 2023. We continued to make strategic, long-term investments in key premium markets, including the recent announcement of our 5 GW solar cell facility in Jeffersonville, Indiana, and our 5 GW solar wafer facility in Thailand, both of which will serve U.S. customers. These will complement our 5 GW solar module facility in Mesquite, Texas, which is set to start production in a few weeks. As we navigate through short-term cyclical market fluctuations, our goal remains consistent which is to build on our long-term competitive position in a rapidly growing global market and deliver sustainable value for our shareholders.”

Yan Zhuang, President ofCanadian Solar’s CSI Solar subsidiary, said, “CSI Solar achieved shipment growth and healthy margin improvement in the third quarter of 2023 despite the challenging market conditions. CSI Solar’s gross and operating margins improved sequentially driven by lower manufacturing costs as we were able to achieve a higher level of vertical integration. This was notwithstanding TOPCon capacity ramp up costs incurred during the quarter, and further rapid declines in solar module prices, which led to an inventory write-down of modules in warehouses intended for certain distributed generation markets. On the utility scale storage side of the business, e-STORAGE has continued to grow, with our total contracted backlog increasing to $2.6 billion, including an impressive $520 million in additional new contracts signed since June 30, 2023. We expect to deliver at least half of these contracts in 2024, making it a record year for e-STORAGE. We strive to provide our customers with the most competitive solution in the market with our relentless focus on quality, safety, value-creation, and end-to-end execution.”

Ismael Guerrero, CEO ofCanadian Solar’s Recurrent Energy subsidiary, said, “As expected, revenue in the third quarter of 2023 was sequentially lower for our Recurrent Energy business. We monetized the 18 MWp Hiroshima Suzuhari project in Japan and several smaller but collectively meaningful projects in Taiwan. Separately, it was a big quarter for our execution teams. Nearly 300 MWp of projects in the U.S. closed $312 million in financing during the quarter, both tax equity and project financing, and are currently under construction. As we continue to execute on our strategy to create and retain the value of the projects that we develop, we are shifting and adding resources to deliver an increased number of the highest quality projects in the market. We expect that this will drive growth of our base of stable, predictable, and profitable cash flows, while generating greater long-term value for shareholders.”

Dr.Huifeng Chang, Senior VP and CFO, added, “In the third quarter of 2023, we generated $1.8 billion in net revenues, a 16.7% gross margin, and net income of $0.32 per diluted share. We generated $158 million in operating cash, as we continue to prioritize cash flow generation and manage inventory levels accordingly. We ended the quarter with a cash position of nearly $3 billion, which we expect to deploy prudently in our long-term strategic growth plans.”

For Q4 2023, the Canadian Solar anticipates total revenue within the $1.6 billion to $1.8 billion range. Gross margin is expected to be between 14% and 16%. CSI Solar estimates that total module shipments, recognized as revenues, will range from 7.6 GW to 8.1 GW, of which roughly 95 MW will be attributed to the Company’s proprietary projects. Total battery energy storage shipments by CSI Solar in Q4 are expected to range from 1.4 GWh to 1.5 GWh, with approximately 720 MWh predicted to generate revenue in early 2024.

Furthermore, Canadian Solar forecasts full-year module shipments will range between 42 GW and 47 GW, alongside a total battery energy storage shipment range of 6.0 GWh to 6.5 GWh, including around 2 GW and 2.5 GWh respectively to their own projects.

Dr. Shawn Qu, Chairman and CEO, commented, “We are very excited about our long-term growth prospects and competitive position, which we are further strengthening with our strategic expansion in the U.S. While margins are expected to rebalance over the next couple of quarters driven by further destocking in the distributed generation channels, we see significant pent-up demand due to lower equipment costs and higher and more volatile energy prices, especially once markets successfully adapt to a higher cost of capital environment. We expect e-STORAGE to remain one of our fastest growing businesses with improved profitability, as we anticipate to more than triple the shipments of our utility-scale energy storage solution next year and gain market share in the global energy storage segment.”

Dr.Shawn Qu, Chairman and CEO, commented, “We delivered solid profitability in the third quarter of 2023 with continued progress on our capacity diversification, despite lower-than-expected market demand growth due to the higher interest rate environment driving higher inventories in certain markets. We significantly ramped up our capacity in the latest N-type TOPCon cell technology, which now accounts for half of our total cell capacity and is expected to reach 60% by the end of 2023. We continued to make strategic, long-term investments in key premium markets, including the recent announcement of our 5 GW solar cell facility in Jeffersonville, Indiana, and our 5 GW solar wafer facility in Thailand, both of which will serve U.S. customers. These will complement our 5 GW solar module facility in Mesquite, Texas, which is set to start production in a few weeks. As we navigate through short-term cyclical market fluctuations, our goal remains consistent which is to build on our long-term competitive position in a rapidly growing global market and deliver sustainable value for our shareholders.”

Yan Zhuang, President ofCanadian Solar’s CSI Solar subsidiary, said, “CSI Solar achieved shipment growth and healthy margin improvement in the third quarter of 2023 despite the challenging market conditions. CSI Solar’s gross and operating margins improved sequentially driven by lower manufacturing costs as we were able to achieve a higher level of vertical integration. This was notwithstanding TOPCon capacity ramp up costs incurred during the quarter, and further rapid declines in solar module prices, which led to an inventory write-down of modules in warehouses intended for certain distributed generation markets. On the utility scale storage side of the business, e-STORAGE has continued to grow, with our total contracted backlog increasing to $2.6 billion, including an impressive $520 million in additional new contracts signed since June 30, 2023. We expect to deliver at least half of these contracts in 2024, making it a record year for e-STORAGE. We strive to provide our customers with the most competitive solution in the market with our relentless focus on quality, safety, value-creation, and end-to-end execution.”

Ismael Guerrero, CEO ofCanadian Solar’s Recurrent Energy subsidiary, said, “As expected, revenue in the third quarter of 2023 was sequentially lower for our Recurrent Energy business. We monetized the 18 MWp Hiroshima Suzuhari project in Japan and several smaller but collectively meaningful projects in Taiwan. Separately, it was a big quarter for our execution teams. Nearly 300 MWp of projects in the U.S. closed $312 million in financing during the quarter, both tax equity and project financing, and are currently under construction. As we continue to execute on our strategy to create and retain the value of the projects that we develop, we are shifting and adding resources to deliver an increased number of the highest quality projects in the market. We expect that this will drive growth of our base of stable, predictable, and profitable cash flows, while generating greater long-term value for shareholders.”

Dr.Huifeng Chang, Senior VP and CFO, added, “In the third quarter of 2023, we generated $1.8 billion in net revenues, a 16.7% gross margin, and net income of $0.32 per diluted share. We generated $158 million in operating cash, as we continue to prioritize cash flow generation and manage inventory levels accordingly. We ended the quarter with a cash position of nearly $3 billion, which we expect to deploy prudently in our long-term strategic growth plans.”

For Q4 2023, the Canadian Solar anticipates total revenue within the $1.6 billion to $1.8 billion range. Gross margin is expected to be between 14% and 16%. CSI Solar estimates that total module shipments, recognized as revenues, will range from 7.6 GW to 8.1 GW, of which roughly 95 MW will be attributed to the Company’s proprietary projects. Total battery energy storage shipments by CSI Solar in Q4 are expected to range from 1.4 GWh to 1.5 GWh, with approximately 720 MWh predicted to generate revenue in early 2024.

Furthermore, Canadian Solar forecasts full-year module shipments will range between 42 GW and 47 GW, alongside a total battery energy storage shipment range of 6.0 GWh to 6.5 GWh, including around 2 GW and 2.5 GWh respectively to their own projects.

Dr. Shawn Qu, Chairman and CEO, commented, “We are very excited about our long-term growth prospects and competitive position, which we are further strengthening with our strategic expansion in the U.S. While margins are expected to rebalance over the next couple of quarters driven by further destocking in the distributed generation channels, we see significant pent-up demand due to lower equipment costs and higher and more volatile energy prices, especially once markets successfully adapt to a higher cost of capital environment. We expect e-STORAGE to remain one of our fastest growing businesses with improved profitability, as we anticipate to more than triple the shipments of our utility-scale energy storage solution next year and gain market share in the global energy storage segment.”

Scan the QR code to follow PVTIME official account on Wechat for latest news on PV+ES

Scan the QR code to follow PVTIME official account on Wechat for latest news on PV+ES

Breaking

Scan the QR code to follow PVTIME official account on Wechat for latest news on PV+ES

Scan the QR code to follow PVTIME official account on Wechat for latest news on PV+ES

Scan the QR code to follow PVTIME official account on Wechat for latest news on PV+ES

Scan the QR code to follow PVTIME official account on Wechat for latest news on PV+ES