PVTIME – In 2023, both the newly added capacity of photovoltaic (PV) solar power and the production capacity of PV products in China reach record highs.

In the first three quarters of 2023, the newly added installed capacity of PV power reached 128.94GW, representing a year-on-year growth of 145%, according to data recently released by China’s National Energy Administration. While about sixty solar power related companies, including Tongwei, Trina Solar, TCL Zhonghuan, JinkoSolar and JA Solar, announced ram up plans with more than 200 billion yuan of financing in the first half of 2023 alone.

However, behind the thriving picture of PV industry in China, the price war started as a consequence of the crazy expansion plans of PV manufacturers. In 2023, the prices of silicon materials, wafers, cells and modules dramatically decreased by 77%, 48%, 35%, 27% compared to the previous year. The low prices have reduced the profits of most manufacturers, and they are shifting their attention to the overseas market.

Chinese PV players have been on the move for years, but in 2023 they appear to be accelerating overseas expansion.

On 17 October 2023, LONGi Green Energy Technology Co. Ltd. (LONGi), the PV giant, completed the first phase of its Serendah Module Plant in Malaysia with a production capacity of 2.8GW of modules, and declared the second phase with 6GW of modules to rejuvenate the local economy and strengthen Malaysia’s progress towards sustainable development, as well as maintain LONGi’s leading position in the global PV market.

On 18 October 2023, TCL Zhonghuan Renewable Energy Technology, the world’s largest supplier of photovoltaic monocrystalline silicon wafers, partnered with Vision Industries to build a crystalline solar wafer factory in the Middle Eastern country with a planned annual capacity of 20GW.

And Trina Solar plans to set up integrated production bases for solar PV products, including silicon material, wafers, cells and modules, with huge production capacity in the Sino-Arab (UAE) Co-operation Demonstration Park and Khalifa Economic Zone in Abu Dhabi. GCL Technology is also planning to build its first polysilicon production plant in Saudi Arabia with a capacity of 120,000 tonnes.

Over twenty Chinese PV product producers have established factories outside of China. Production capacity is expected to reach 44.6GW of silicon wafers, 60GW of solar cells, and almost 90GW of modules in the coming years.

Public data shows that at least nine Chinese PV companies, which produce and sell PV film, glass, frames, and backsheets, have established factories outside of China, primarily in Southeast Asian countries.

What is driving Chinese PV manufacturers to go abroad and why is the overseas location so attractive to them?

The overcapacity caused by the rapid growth of the PV industry in China is one of the main factors. Taking polysilicon as an example, the combined capacity of the top 10 polysilicon producers in China will exceed 918,000 tonnes by the end of 2022, with around 1.5 million tonnes of capacity expected from newly launched polysilicon projects in 2023. Most of the new capacity is expected to come online in Q3 2023, and although the bold capacity expansion has slowed in Q4 2023, the overcapacity has led to the unprecedented price decline. Polysilicon prices are approaching the cost of most companies, and lower profit margins have become a harsh winter for a large number of Chinese PV companies.

The active development of overseas markets is a proven method to digest overcapacity. Therefore, more and more PV companies are looking to the overseas market in a situation where supply exceeds demand in the domestic market.

The growing export volume is another factor for Chinese PV manufacturers to set up overseas facilities. In recent years, China’s PV giants have played a leading role in the global solar power market. China’s global market share of silicon, wafers, cells and modules reached 86.95%, 97.90%, 86.69% and 80.80% respectively, according to CPIA data. China’s PV products were exported to more than 200 countries and regions around the world, with an export value of US$51.25 billion, up 80.3% year on year.

From January to July 2023, China’s PV product exports reached US$32 billion, up about 6% year on year, of which, from January to July 2023, China’s PV module exports totalled US$26.12 billion, up 2.1% year on year, and total module exports were 123 GW, up 30.4% year on year.

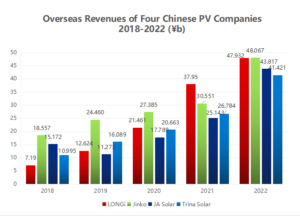

The overseas market is crucial for Chinese PV companies. The export value of LONGi, Jinko, JA Solar and Trina Solar exceeded US$40 billion in 2022. Their overseas revenue accounted for 39.42%, 74.64%, 67.22% and 61.03% of their total revenue in the first half of 2022, and 43.77%, 62.37%, 57.56% and 47.6% respectively in 2023.

Inverter companies are particularly strong in their dependence on the overseas market when compared to module leaders. In 2018, Sungrow’s overseas revenue was 1.382 billion yuan, which rose sharply to 19.062 billion yuan in 2022. GoodWe and Ginlong Technologies also experienced similar growth. This is due to the higher gross profit margin in the overseas market compared to the Chinese market. According to GoodWe’s annual report, the gross profit margin for the Chinese market in 2022 was 13.37%, while the overseas market achieved 37.12%.

Most Chinese PV manufacturers prefer to build their factories in Southeast Asia due to several advantages, including proximity to neighbouring countries, lower costs, and relatively stable policies. Companies such as LONGi, JinkoSolar, Trina Solar, JA Solar, Canadian Solar, Chint/Astronergy, Risen, GCL, and Sungrow have established factories in Malaysia, Vietnam, Thailand, and other Southeast Asian countries, with a production capacity in the gigawatt range.

Some Chinese PV manufacturers have established factories in the EU to provide clean energy with stable electricity. The EU is a core market for the global PV industry due to the growing demand for solar PV products caused by high-energy-consuming economic structures and high costs of power generation. Additionally, the revenue in the European market is substantial. For instance, Trina Solar’s gross profit on sales in Europe was 12.13% in 2022, which is higher than the 10.32% in Japan.

The United States is a significant PV solar market, with the world’s second-largest installed demand. In 2022, more than 20GW of solar power was newly added there, and this is expected to reach 63GW by the end of 2024. However, the current production capacity of solar modules in the United States is less than 7GW per year, which is far insufficient to meet its demand. Large-scale and fast growth of PV solar is required to meet the demand. Furthermore, module prices in the United States are at least 0.1 dollars per W higher than in the international market. BNEF estimates that the gross profit in the United States will reach 26% to 32% by the end of 2023, which is significantly higher than in Asian countries.

The solar industry in the United States has great potential for huge profits. Chinese PV providers are keen to promote the development of PV programs in the US. However, entering the US PV market is challenging due to trade policies that have been in place against Chinese PV companies for almost a decade.

These policies create trade barriers that prevent Chinese PV manufacturers from deploying solar power systems in the United States. The US government recognises the importance of clean energy and is making efforts to be more accommodating by releasing supportive subsidy policies for building factories in the US. However, the fulfillment of these policies is uncertain.

Moreover, the recovery of US solar companies will have an impact on foreign factories. Suniva, a prominent US solar energy company, has announced its plan to reopen its solar cell factory in Norcross, Georgia. The production capacity will gradually increase to 1GW in the first phase by spring 2024, and further expand to 2.5GW in the second phase.

Therefore, controlling costs, such as investment, construction, and management costs, poses a challenge for Chinese PV companies. Additionally, managing risks associated with trade policies in the United States is also difficult.

On the other hand, due to the rapid growth of photovoltaic installed capacity, India, the Middle East, Turkey, and other places are gradually emerging as markets. The Middle East has become a new choice for Chinese PV enterprises to build factories overseas with the support of the Belt and Road Initiative, boosting the PV market in related countries and regions.

As the largest oil exporting region in the world, the Middle East, particularly Saudi Arabia and the United Arab Emirates, are under immense pressure to reduce carbon emissions. They are adapting to the global trend of promoting new energy transformation. Currently, the six major oil-producing countries in the Middle East have made climate commitments to the world. Bahrain, Saudi Arabia, and the United Arab Emirates have committed to achieving net-zero emissions as part of their climate goals. Saudi Arabia has set a target to generate 50% of its electricity from renewable energy sources by 2030.

The Middle East is blessed with abundant sunshine, making it an ideal region for PV solar installations. In 2022, Middle Eastern countries imported 11.4GW of PV modules from China, representing a 78% increase from 2021, according to Infolink data.

To promote the green energy transformation in the Middle East region, Chinese PV companies are no longer satisfied with merely supplying solar cells and modules. Instead, they are collaborating with local communities to establish PV production bases.

Chinese PV companies are no longer content with simply supplying goods in the fast-growing market. Instead, they are adapting to the times by establishing factories in the Middle East, which has become an important market for them. Chinese PV companies are taking advantage of the current opportunity to promote green energy transformation in the Middle East, from ‘selling out’ to ‘manufacturing localisation’. As mentioned earlier, TCL Zhonghuan has partnered with Vision Industries to build a solar crystalline wafer factory in a Middle Eastern country with a planned capacity of 20GW per year. Trina Solar plans to launch an integrated line of solar PV products, including silicon material, wafers, cells, and modules, with significant production capacity in the Sino-Arab (UAE) Co-operation Demonstration Park and Khalifa Economic Zone in Abu Dhabi. Similarly, GCL Technology intends to construct its first polysilicon manufacturing plant in Saudi Arabia with a capacity of 120,000 tonnes.

It is undeniable that one of the key factors propelling Chinese PV companies to the top of the global PV market is their ability to control costs. Smart production lines, sufficient manpower, a secured supply chain, efficient management, supportive policies, and self-development in technology and innovation in China result in low costs and mass production. However, Chinese companies that set up factories outside of China find it difficult to leverage these advantages. The rising costs of materials, equipment, and manpower pose a significant challenge for Chinese PV companies. JA Solar has invested $60 million in a PV products factory in the US with a capacity of 2GW of solar modules. However, the cost is significantly higher than in China, and foreign manufacturers may not prefer the policies.

Fortunately, Chinese PV companies are striving to do everything possible. The healthy development of the PV market is expected to contribute to the deployment of low-carbon energy, particularly PV solar, which is urgently needed to address global climate concerns. It is important for everyone to cooperate for the common good of mankind, to reduce temperatures, protect the environment, and live together on Earth.

Scan the QR code to follow PVTIME official account on Wechat for latest news on PV+ES

Scan the QR code to follow PVTIME official account on Wechat for latest news on PV+ES