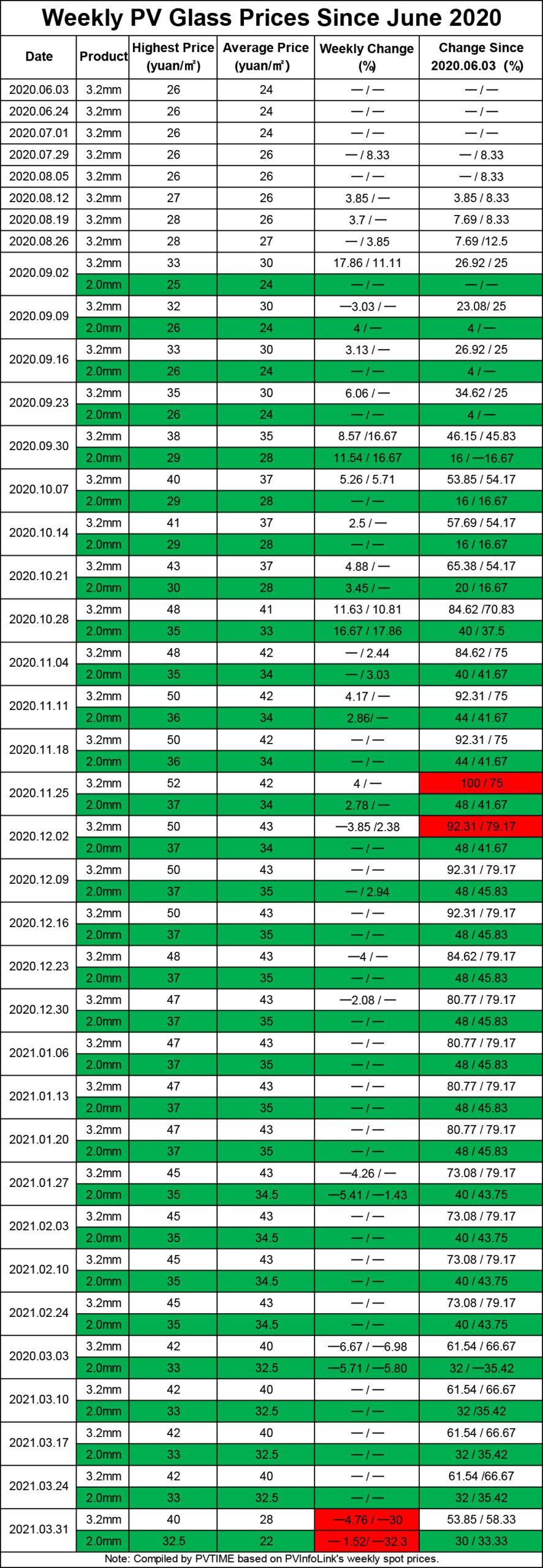

PVTIME – PVInfoLink’s spot prices released on March 31 revealed PV glass price cuts that far exceeded market expectations. The price of 3.2mm coating PV glass fell by 30% (12 yuan/㎡) and the price of 2.0mm coating PV glass slid by 32.3% (10.5 yuan). However, industry insiders believe that these price levels are still far from the reasonable price of 25 to 28 yuan/㎡ and that the price of PV glass will likely continue to fall throughout the year.

Regarding the sudden drop in the price of photovoltaic glass, an upstream company commented: “The price dropped too suddenly, and I don’t know the reason. Although there are several opinions about the reasons for the sudden price drop, none of them has been widely accepted. There is no clear answer to the main cause for the price reduction.”

PV glass prices skyrocketed in 2020

The beginning of the photovoltaic glass price uptrend can be traced back to the end of July of 2020, and the substantial increases started in September.

At the end of July 2020, the average price of photovoltaic glass rose from 24 yuan/㎡ to 26 yuan/㎡, an increase of 8.33%. Prices began to rise rapidly at the beginning of September, with the highest price and average price rising by 17.86% and 11.11%, respectively. Compared with the beginning of June, the highest price and average price increased by 26.92% and 25%, respectively, and the unit prices came to 33 yuan/㎡ and 30 yuan/㎡.

The price of PV glass reached its highest point in late November and early December last year. During this period, the highest unit price of 3.2mm coating PV glass reached 52 yuan/㎡, an increase of 100% from June; the average unit price reached 43 yuan/㎡, an increase of 79.17% since June.

Entering 2021, after the tail end of peak capacity installations, the price of photovoltaic glass began to slowly decrease. The unit price of 3.2mm coating PV glass at the high end of the spectrum sustained 47 yuan/㎡, 45 yuan/㎡, and 42 yuan/㎡, respectively, for about a month each, and the average unit price was stable at between 40 yuan/㎡ and 43 yuan/㎡. The unit price of 2.0mm coating PV glass at its high hovered between 35 to 37 yuan/㎡, and the average unit price was between 32.5 to 35 yuan/㎡. The declining price trend was apparent but the amount left something to be desired for.

Regarding the cause for the soaring price of photovoltaic glass in 2020, multiple factors work together to cause an imbalance between the supply and demand which caused the price to rise rapidly. Huacheng Securities believes that the market share increase for dual glass modules and capacity shut down due to the pandemic are some of the reasons behind this increase. According to industry organizations, the market share of dual glass modules will reach 30% in 2020, an increase of 10% from 2019. By 2022, the market share of dual glass modules will exceed 60%.

Record price led to record profitability for glass manufacturers

The photovoltaic glass market was dominated by Xinyi Solar and Flat Glass Group in 2020. Data shows that China’s photovoltaic glass production accounted for more than 95% of the global photovoltaic glass production in 2019, and the production capacity of the two accounted for 30.8% and 20.9%, respectively.

Xinyi Solar reported revenue of 10.34 billion yuan in 2020, an increase of 35.4% year-on-year while Flat Glass Group reported revenue of 6.26 billion yuan, a year-on-year increase of 30.24%. Flat Glass Group’s net profit in the fourth quarter reached 817 million yuan, an increase of 289.59% over the previous quarter. Regarding their performance improvements, both parties said they benefited from the prosperous conditions of the photovoltaic industry.

Additionally, Luoyang Glass’s revenue increased by 64.2% year-on-year, and its net profit increased by 506.2% year-on-year; Ancai Hi-Tech’s revenue increased by 13.6% year-on-year, and its net profit increased by 458.6% year-on-year; Almaden’s revenue increased by 52.2% year-on-year, and its net profit rose 241.3% year-on-year.

Behind the sudden price drop

The rise in the price of photovoltaic glass and the increase in profits have attracted more companies looking to get a piece of the pie.

On December 16, 2020, the Ministry of Industry and Information Technology openly solicited opinions on the “Implementation Measures for Capacity Replacement in the Cement and Glass Industries (Revised Draft)” (hereinafter referred to as the “Revised Draft”). The revised draft listed four situations where additional capacity expansion schemes could be carried out for the aforementioned industries, and photovoltaic rolled glass was one of the four.

The disclosure of the revised draft is regarded by the industry as deregulation of the photovoltaic glass industry, which will effectively alleviate the supply shortage of photovoltaic glass.

After that, there was a “prosperous” situation in which old players expanded production capacity and new players entered the market. This momentum will continue in 2021. It is understood that by the end of 2021, Xinyi Solar’s production capacity will reach 13,800 tonnes and Flat Glass Group’s total production capacity is expected to reach 12,200 tonnes.

Although some photovoltaic glass enterprises began expanding production or building new production lines in 2020, due to the construction period of 1-1.5 years and other factors, it will take at least 2 years to bring new production capacity or the production process up to par with the capabilities of top players.

Huachuang Securities predicts that 27,670 tonnes and 26,100 tonnes of capacity will be added in 2021 and 2022, respectively, representing a year-on-year increase of 94% and 46%. Huachuang Securities also predicts that in the third quarter of 2021, available supply will begin to outpace demand.

Energy Trend believes that judging from the market situation in early 2021, the upward price trend of photovoltaic glass has ended, and glass prices are expected to decrease in the off-season. However, Energy Trend analysts believe that the relative shortage of photovoltaic glass has not been completely resolved. Energy Trend expects that the supply and demand situation of photovoltaic glass may be alleviated in the first half of 2022.

Cinda Securities predicts that the price range of 3.2mm and 2.0mm PV glass in 2021 will be between 30-35 yuan/㎡ and 25-30 yuan/㎡ respectively.

Some analysts believe that the cause of the sudden price drop is due to the overcapacity of photovoltaic glass. When Guolian Securities rated Flat Glass Group, it stated that: “The production capacity of photovoltaic glass is gradually being brought on line, the supply of photovoltaic glass exceeds demand, and the price is expected to fall.”

There is also a view that in the past year, even though the big players have expanded their production, the strength of the new players should not be underestimated. Their emergence in the space may have a threatening impact on the status of leading companies and cause them to place pressure on the newcomers by reducing prices to protect their own interests.

A few days ago, LONGi and Tongwei released product quotations one after another. Silicon wafer prices sustained but the price of solar cells has dropped significantly. At the same time, GCL has stated that the price of its silicon materials will not rise. This series of actions are interpreted by the industry as a battle between upstream and downstream enterprises. There are also those who believe that in 2021, with downstream enterprises being pushed to the limit, the prices of silicon materials and silicon wafers will rise to place pressure on upstream enterprises. Module producers will then respond with production reductions, which will increase the inventory of photovoltaic glass and reduce the price of photovoltaic glass.