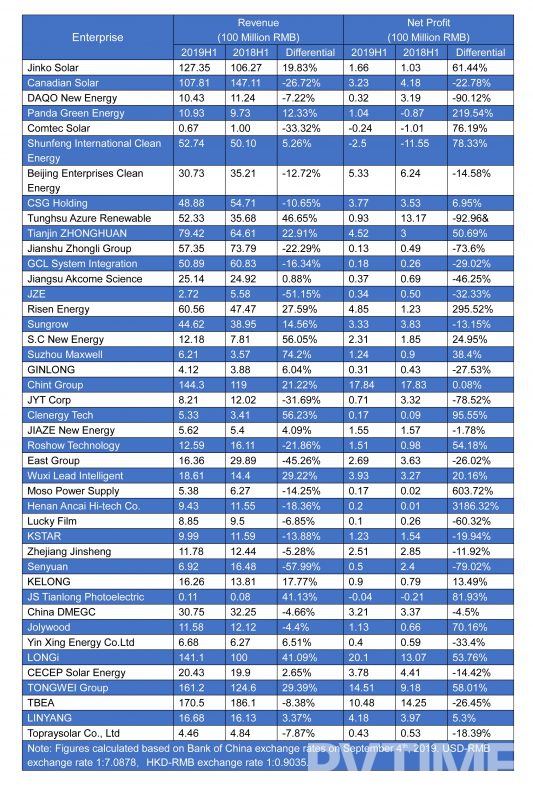

Recently, many listed Chinese photovoltaic enterprises have disclosed their financial reports for the first half of 2019. From January to June, half of these PV enterprises achieved growth in revenue, with the top 10 enterprises accounting for 63.09% of the sector total. 60% of enterprises have shown various degrees of decline in their net profit but the industry profit concentration continued to increase for the top 10 enterprises.

Among them, TBEA, TONGWEI Group, Chint, LONGi, Jinko Solar, Canadian Solar, and Golden Concord Group Limited (GCL) reached the “billion club” mark with revenues of 17.05 billion yuan, 16.12 billion yuan, 14.43 billion yuan, 14.11 billion yuan, 12.735 billion yuan, 10.781 billion yuan and 10.02 billion yuan, respectively.

Additionally, companies whose main operations revolving around manufacturing photovoltaic equipment performed well, benefiting from the growth in demand for PERC batteries in the first half of the year. S.C New Energy, Suzhou Maxwell and DR Laser all saw revenue increases of 50% or better.

Among the 43 photovoltaic enterprises, the top 10 performers accounted for 81.45% of the total net profit for all enterprises, which is 10% higher than that of the first half of 2018. LONGI, Chint, TBEA, and TONGWEI’s net profits all exceeded the billion mark, with TONGWEI surpassing this threshold for the first time. Henan Ancai Hi-tech Co., Risen Energy, Moso Power Supply, and Panda Green Energy all had net profit increases of more than 200% year over year.

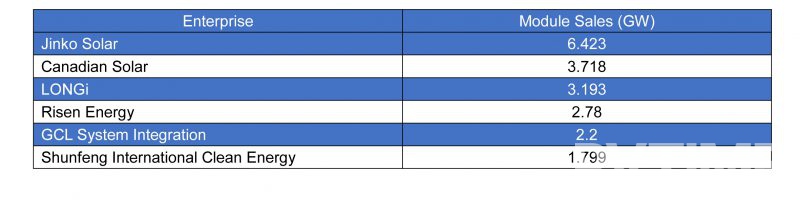

From the perspective of module manufacturers, while domestic installed capacity of new photovoltaic devices declined significantly in the first half of 2019 compared to 2018, it is the pioneering of overseas markets that safeguarded the rapid growth of business sales.

According to the financial reports of various enterprises, LONGi’s overseas sales of monocrystalline modules reached 2.42GW in the first half of this year, an increase of 252% over last. Export sales for Risen Energy accounted for 66.89% of its revenue, with sales in Ukraine alone reaching 736MW. Shunfeng International Clean Energy’s largest overseas client accounted for 6% of its total revenue. GCL System Integration’s overseas sales reached 1.33GW, accounting for more than 60% of their total module sales.

Following the fundamental change in China’s domestic photovoltaic demand spearheaded by the need for affordable PV prices and elimination of subsidies, developing domestic and overseas market strategies centred around cost control should be the main focal point for enterprises. Enterprises that are unable to remain competitive and those with excessive dependence on subsidies will be forced out and the domestic PV industry will enter the stage of integration as it moves toward providing affordable PV for all.