PVTIME – Canadian Solar Inc. (“Canadian Solar” or the “Company”) (NASDAQ: CSIQ) today announced financial results for the quarter ended September 30, 2021.

Highlights

- Solar module shipments of 3.9 GW in the third quarter of 2021, in line with guidance of 3.8 GW to 4.0 GW.

- Revenue increased 34% year-over-year (“yoy”) to $1.23 billion, in line with guidance of $1.2 billion to $1.4 billion.

- Gross margin of 18.6%, above guidance range of 14% to 16%.

- Net income attributable to Canadian Solar of $35 million, or $0.52 per diluted share.

- 2.9 GWh of battery storage projects under construction and 21 GWh of total storage development pipeline.

- Continuing to make progress on the carve-out IPO of the CSI Solar subsidiary.

Dr. Shawn Qu, Chairman and CEO, commented, “We delivered our strongest quarterly performance since the start of COVID, with 34% year-over-year topline growth and better-than-expected profitability. While operational challenges have intensified recently, emerging energy crises across the world underscore the urgency to accelerate the deployment of clean, renewable energy paired with reliable battery storage technology. We are also encouraged by the positive action from Glasgow’s COP26 and supportive policies by an increasing number of governments. At Canadian Solar, we continue to invest in the research and development of competitive solar and battery storage system solutions, and in expanding our global sales channels. We will also grow and monetize our pipeline of sought-after solar and battery storage projects of 24 GWp and 21 GWh, respectively, while carefully managing short-term market fluctuations and building sustainable value for our shareholders.”

“Regarding the previously announced carve-out IPO of CSI Solar, we are addressing the third round of comments from the Shanghai Stock Exchange, in line with usual review procedures.”

Ismael Guerrero, Corporate VP and President of Canadian Solar’s Global Energy subsidiary, said, “One of the key highlights for this quarter is the monetization of our first stand-alone battery storage project, the Crimson Project of 350 MW or 1,400 MWh in California. Construction on this landmark project has already started, underscoring the multi-year, value creation potential of battery storage projects across the world. From a market standpoint, certain project construction schedules are starting to be delayed due to rising costs, although we continue to sign higher-priced PPAs and expand our global solar and storage pipeline, positioning ourselves for long-term growth.”

Yan Zhuang, President of Canadian Solar’s CSI Solar subsidiary, said, “The operational environment remains challenging driven by three key factors: a global logistics bottleneck, rising material costs across the board, and power curtailment in China adversely affecting production. We continue to take proactive measures to improve the situation, such as declining low priced orders and raising prices more aggressively to prioritize margins. We are also selectively slowing capacity expansion plans to optimize utilization rates. Meanwhile, we continue to make significant progress on our battery storage solutions, having delivered approximately 550 MWh on battery storage shipments during the first three quarters of this year. We are also investing in the R&D of next-generation solar and storage products, further deepening our sales channel partnerships, and expanding our brand through high quality, differentiated, clean energy solutions and services.”

Dr. Huifeng Chang, Senior VP and CFO, added, “In the third quarter, we achieved $1.2 billion in revenue, in line with guidance, and a gross margin of 18.6%, which was well ahead of guidance. We used $29 million in operating cash during the quarter as inventory turnover slowed due to logistics challenges. We have scaled up manufacturing with approximately $420 million of capital expenditure year-to-date, and plan to reduce our full-year capital expenditure plan to approximately $500 million reflecting a prudent capital allocation strategy. We ended the quarter with $1.4 billion in cash and will remain disciplined in capital deployment.”

Third Quarter 2021 Results

Total module shipments in the third quarter of 2021 were 3.87 GW, a 22% year-over-year (“yoy”) increase and 6% quarter-over-quarter (“qoq”) increase. Of the total, 173 MW was shipped to the Company’s own utility-scale solar power projects.

Net revenues in the third quarter of 2021 were up 34% yoy and down 14% qoq to $1,229 million. The sequential decline primarily reflects the lower revenue from pre-construction project sales, or projects sold at notice to proceed (“NTP”). This was partially offset by a higher module average selling price (“ASP”). The yoy improvement was driven by an increase in module shipments and ASPs.

Gross profit in the third quarter of 2021 was $229 million, up 24% qoq and 28% yoy. Gross margin in the third quarter of 2021 was 18.6%, above guidance of 14% to 16% driven by higher margin contribution from project sales, higher module ASPs, manufacturing efficiency gains, and a benefit from U.S. anti-dumping (“AD”) and countervailing duty (“CVD”) true up. Gross margin was 17.6%, if excluding the AD/CVD true-up benefit of $12 million.

Total operating expenses in the third quarter of 2021 were $176 million compared to $158 million in the second quarter of 2021. The sequential increase was mainly driven by higher shipping and handling expenses, partially offset by an increase in other operating income.

Non-cash depreciation and amortization charges in the third quarter of 2021 were $71 million, compared to $66 million in the second quarter of 2021, and $56 million in the third quarter of 2020.

Net foreign exchange loss in the third quarter of 2021 was $14 million, compared to a net loss of $3 million in the second quarter of 2021 and a net loss of $13 million in the third quarter of 2020. The net foreign exchange loss was mainly driven by the strengthening of the U.S. Dollar against currencies such as the Brazilian Real.

Income tax benefit in the third quarter of 2021 was $3 million, compared to $2 million of income tax benefit in the second quarter of 2021 and $21 million of income tax expense in the third quarter of 2020. The benefit was a result of the utilization of net operating losses.

Net income attributable to Canadian Solar in the third quarter of 2021 was $35 million, or $0.52 per diluted share, compared to net income of $11 million, or $0.18 per diluted share in the second quarter of 2021. On a non-GAAP basis, net income attributable to Canadian Solar was $28 million, or $0.42 per diluted share. This excluded a $7 million AD/CVD true-up benefit, net of income tax effect and AD/CVD provision true-up attributable to non-controlling interests. For a reconciliation of results under generally accepted accounting principles in the United States (“GAAP”) to non-GAAP results, see the accompanying table “About Non-GAAP Financial Measures”.

The increase in basic shares outstanding was primarily due to the issuance of 1.1 million and 2.6 million shares in connection with the at-the-market equity offering program for the three months and nine months ended September 30, 2021, respectively. The increase in diluted shares outstanding was primarily due to the dilutive effect of convertible notes in the third quarter. For the three months and nine months ended September 30, 2021, the number of ordinary shares issuable upon the conversion of the convertible notes, which were dilutive and included in the computation of diluted earnings per shares, was 6.3 million shares.

Net cash used by operating activities in the third quarter of 2021 was $29 million, compared to $61 million in the second quarter of 2021. The operating cash outflow was mainly driven by an increase in project assets and net working capital.

Total debt was $2.3 billion, as of September 30, 2021, compared to $2.2 billion, as of June 30, 2021. The increase in total debt was mainly driven by an increase in working capital facilities and project financing. Non-recourse debt used to finance solar power projects increased to $558 million as of September 30, 2021, from $454 million as of June 30, 2021.

Battery Storage Opportunities

Canadian Solar is strategically positioned in the battery storage market, both in solar plus battery storage, as well as in stand-alone storage opportunities. The rapid growth of the energy storage market is driven by technology improvements, declining battery storage costs, rising penetration of renewable energy and accelerating retirements of fossil fuel capacity.

Canadian Solar has a global network and strong brand recognition given its leadership in both module manufacturing and solar project development. Both CSI Solar and Global Energy have focused strategically on their respective energy storage businesses:

- Under Global Energy, energy storage project development is fully integrated within the main solar development teams. Given the segment’s large and growing pipeline, it is positioned to capture utility-scale energy storage projects.

- Under CSI Solar, the battery storage solutions team focuses on delivering bankable, end-to-end, integrated battery storage solutions for utility scale, commercial and industrial, as well as residential applications. These systems solutions will be complemented with long-term service agreements, including future battery capacity augmentation services.

While there are synergies between the Global Energy and CSI Solar teams, both operate independently and in different segments of the battery storage value chain. The project pipeline for each team should be assessed independently. Please refer to the Global Energy and CSI Solar sections of this document for specific pipeline figures.

Global Energy Segment

Canadian Solar has one of the world’s largest and most geographically diversified utility-scale solar and energy storage project development platforms, with a strong track record of originating, developing, financing, and building over 6.2 GWp of solar power plants across six continents. The Company has built a leadership position in solar project development with over 24 GWp total pipeline, as well as in energy storage project development with over 21 GWh of aggregate pipeline.

The continued pipeline expansion and strong project development track record will support Global Energy’s growth in three key areas:

- Project sales: The Company plans to grow its volume of project sales by a compound annual growth rate of 25% over the next five years, well ahead of the global market growth rate of approximately 20% according to many research reports.

- Investment vehicles: The Company is optimizing its project monetization strategy by establishing local investment vehicles that will help maximize the value of its project assets. The Company also intends to retain minority ownership in these vehicles. By 2025, the Company plans to reach at least 1 GW of combined net ownership in solar power projects through these vehicles. This approach will help the Company build and grow a stable base of long-term cash flows from contracted electricity. The Company will be able to recycle a large portion of the capital into developing new solar projects for growth. Meanwhile, Canadian Solar expects to capture additional operational value throughout the partial ownership period, including long-term cash flows from power sales, operations and maintenance (O&M), asset management and other services (see point 3). The Company currently owns a 15% stake in the Canadian Solar Infrastructure Fund (“CSIF”, TSE: 9284), the largest listed Japanese infrastructure fund on the Tokyo Stock Exchange. The Company also established the Brazilian Participation Fund for Infrastructure projects (FIP-IE), as well as similar project investment vehicles in European countries such as Italy. Through launching these localized vehicles, Canadian Solar is building up its expertise in designing investment vehicles in local markets that will help maximize the value of its project assets.

- Services: Canadian Solar currently manages over 2 GW of operational projects under long-term O&M agreements, and an additional 2 GW of contracted projects that will be operated and maintained by the Company once they are placed in operation. The Company’s target is to reach 11 GW of projects under O&M agreements by 2025.

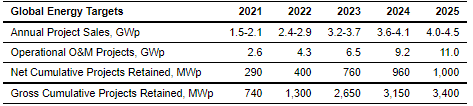

Management targets to achieve the following over the next 5 years:

* Net projects retained represents CSIQ’s net partial ownership of solar projects, the gross number represents the aggregate size of projects including the share which is not owned by CSIQ.

Solar Project Pipeline

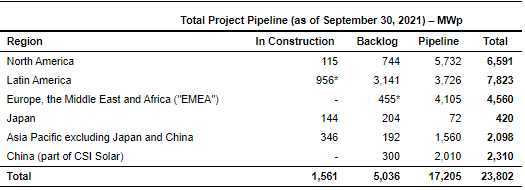

As of September 30, 2021, the Company’s total project pipeline was 23.8 GWp, including 1.6 GWp under construction, 5.0 GWp of backlog, and 17.2 GWp of earlier stage pipeline. The backlog includes projects that have passed their Risk Cliff Date and are expected to be built in the next one to four years. A project’s Risk Cliff Date depends on the country where the project is located and is defined as the date on which the project passes the last high-risk development stage. This is usually after the projects have received all the required environmental and regulatory approvals, and entered into interconnection agreements, feed-in tariff (“FIT”) arrangements and power purchase agreements (“PPAs”). Over 90% of projects in backlog are contracted (i.e., have secured a PPA or FIT), and the remaining are reasonably assured of securing PPAs.

The Company’s pipeline includes early- to mid-stage project opportunities currently under development but that are yet to be de-risked.

The following table presents the Company’s total project pipeline.

*Note: Gross MWp size of projects includes 492 MWp in construction in Latin America,and 110 MWp in backlog in EMEA, that are not owned by Canadian Solar or have been sold to third parties.

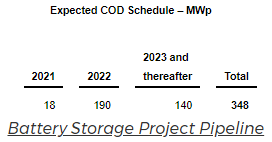

The Company has 348 MWp of premium, high FIT projects in Japan. The table below sets forth the expected COD schedule of the Company’s project backlog in development and construction in Japan, as of September 30, 2021:

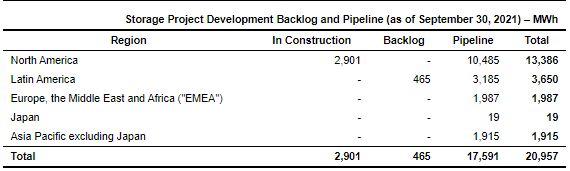

The Global Energy segment has been actively developing utility-scale solar plus energy storage projects, as well as stand-alone battery storage projects. The Company found that virtually all its solar power projects under development can co-host energy storage facilities and has done so since the first quarter of 2021. By co-hosting energy storage facilities with solar power plants on the same piece of land and using the same interconnection point, the Company expects to significantly enhance the value of its assets under development.

Canadian Solar has already signed several storage tolling agreements with a variety of power purchasers, including community choice aggregators, investor-owned utilities, universities, and public utility districts. The Company has also signed development services agreements to retrofit operational solar projects with battery storage, many of which were previously developed by the Company.

The table below sets forth Global Energy’s storage project development backlog and pipeline.

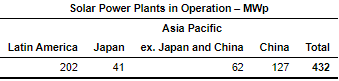

Solar Power Plants and Battery Storage Projects in Operation

As of September 30, 2021, the Company’s solar power plants in operation totaled 432 MWp, with a combined estimated net resale value of approximately $360 million to Canadian Solar. The estimated resale value is based on selling prices that Canadian Solar is currently negotiating or transaction prices of similar assets in the relevant markets.

Note: Gross MWp size of projects, includes 81 MWp in Latin America and 26 MWp in Asia Pacific ex. Japan and China already sold to third parties. China portfolio is part of CSI Solar.

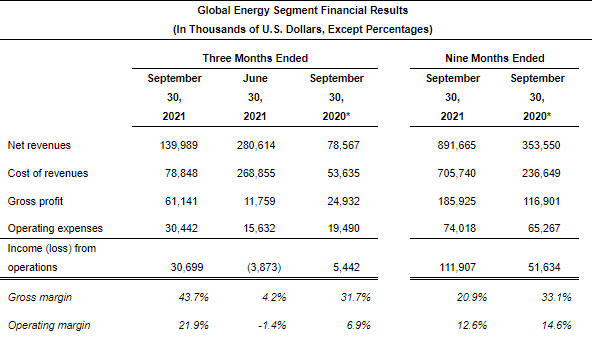

Operating Results

The following table presents unaudited select results of operations data of the Company’s Global Energy segment.

*Historical amounts for the three months and nine months ended September 30, 2020, have been revised to conform

to the current period presentation

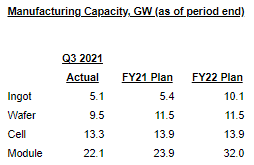

CSI Solar Segment

CSI Solar’s 2021 and 2022 capacity expansion targets are detailed below.

Note: CSI Solar’s capacity expansion plans are subject to change without notice based on market conditions and capital allocation plans.

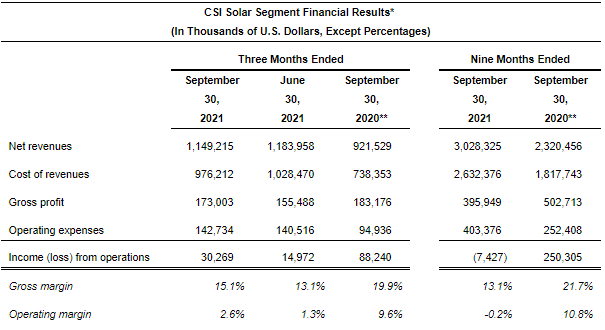

Operating Results

The following table presents unaudited select results of operations data of the CSI Solar segment for the periods indicated.

* Includes effects of both sales to third-party customers and to the Company’s Global Energy Segment. Please refer

to the attached financial tables for intercompany transaction elimination information. Income (loss) from operations reflects

management’s allocation and estimate as some services are shared by the Company’s two business segments

** Historical amounts for the three months and nine months ended September 30, 2020 have been revised to conform to the

current period presentation.

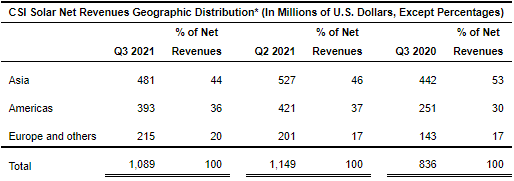

The table below provides the geographic distribution of the net revenues of CSI Solar:

*Excludes sales from CSI Solar to Global Energy.

CSI Solar shipped 3.9 GW of modules to nearly 70 countries in the third quarter of 2021. The top five markets ranked by shipments were China, the U.S., Brazil, Germany and Thailand.

Battery Storage Solutions

Within CSI Solar, the battery storage solutions team delivers competitive turnkey, integrated battery storage solutions, including bankable and fully wrapped capacity and performance guarantees. These guarantees are complemented with long term O&M agreements, which include future battery capacity augmentation services and bring in longer term, stable income.

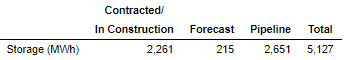

The table below sets forth CSI Solar’s battery storage system integration’s contracted projects and/or under construction, those in high probability forecast, and pipeline, as of September 30, 2021.

Contracted/in construction projects are expected to be delivered within the next 12 to 18 months. Forecast projects include those that have more than 75% probability of being contracted within the next 12 months, and the remaining pipeline includes projects that have been identified but have a below 75% probability of being contracted.

Business Outlook

The Company’s business outlook is based on management’s current views and estimates given factors such as existing market conditions, order book, production capacity, input material prices, foreign exchange fluctuations, anticipated timing of project sales, and the global economic environment. This outlook is subject to uncertainty with respect to, among other things, customer demand, project construction and sale schedules, product sales prices and costs, and the global impact of the ongoing COVID-19 pandemic. Management’s views and estimates are subject to change without notice.

For the fourth quarter of 2021, the Company expects total module shipments to be in the range of 3.7 GW to 3.9 GW, including approximately 250 MW of module shipments to the Company’s own projects. Total revenues are expected to be in the range of $1.5 billion to $1.6 billion. Gross margin is expected to be between 14% and 16%.

For the full year of 2021, battery storage shipments, accounted in CSI Solar, are expected to be in the range of 840 MWh to 860 MWh. Global Energy project sales are expected to be in the range of 1.5 GW to 2.1 GW, reflecting the timing of certain project sales which could be recognized either in the fourth quarter of 2021 or first quarter of 2022.

For the full year of 2022, the Company expects total module shipments to be in the range of 20 GW to 22 GW, battery storage shipments to be in the range of 1.4 GWh to 1.5 GWh, and total project sales to be in the range of 2.4 GW to 2.9 GW. Revenue for the full year of 2022 is expected to be in the range of $6.5 billion to $7.0 billion.

Dr. Shawn Qu, Chairman and CEO, commented, “We have walked away from low-priced orders as we control shipment volume to protect margins, as reflected in the updated shipment and revenue guidance in the fourth quarter. We believe the adverse macro conditions of higher material costs and global logistics bottlenecks are temporary. As we look forward to next year, our focus is on improving Canadian Solar’s long-term position and competitiveness, and our strategy is to further expand our solar module market share, invest in technology and upstream capacity, while benefiting from overcapacity in the wafer and cell manufacturing levels. We are also positive about the growth of our battery storage business, which is on track to grow by 70% on its second year of deliveries, representing another record year. Overall, long-term market fundamentals remain positive with both company and market-specific catalysts in each of our business segments.”

Recent Developments

On November 8, 2021, Canadian Solar announced it was awarded 52 MWp for the solar PV project Caracoli in the recent public auction by Colombia’s Ministry of Energy. The energy awarded will be acquired by a pool of reputable off-takers and will start delivering clean energy from 2023 through an inflation-indexed, Colombian Peso-denominated, 15-year power purchase agreement.

On September 9, 2021, Canadian Solar announced its majority-owned subsidiary, CSI Solar Co., Ltd. closed a 350 MW / 1400 MWh contract to provide fully-integrated battery storage system, EPC and long term maintenance service to the Crimson stand-alone battery storage project in Riverside County, California.

On September 8, 2021, Canadian Solar announced that its wholly owned subsidiary Recurrent Energy sold an 80% stake in its 350 MW / 1400 MWh Crimson storage project to Axium Infrastructure. Recurrent Energy will retain the remaining 20% ownership. Construction of the storage project began in Q3 2021 and is expected to reach commercial operation by the summer of 2022.

On September 7, 2021, Canadian Solar announced that it signed long-term O&M agreements with two solar PV plus battery storage projects in the U.S., the Slate and Mustang projects that were both developed by Canadian Solar’s wholly owned subsidiary Recurrent Energy and are currently owned by Goldman Sachs Asset Management Renewables Power (Goldman Sachs).

Conference Call InformationThe Company will hold a conference call at 8:00 a.m. U.S. Eastern Standard Time on Thursday, November 18, 2021 (9:00 p.m., Thursday, November 18, 2021 in Hong Kong) to discuss its third quarter 2021 results and business outlook. The dial-in phone number for the live audio call is +1-833-239-5565 (toll-free from the U.S.), +852-3018-6771 (local dial-in from Hong Kong), 400-8205-286 (local dial-in from Mainland China) or +1-332-208-9468 / +65-6713-5590 from international locations. The passcode for the call is 6095653. A live webcast of the conference call will also be available on the investor relations section of Canadian Solar’s website at www.canadiansolar.com

A replay of the call will be available 2 hours after the conclusion of the call until 8:00 a.m. U.S. Eastern Standard Time on Friday, November 26, 2021 (9:00 p.m., November 26, 2021 in Hong Kong) and can be accessed by dialing +1-855-452-5696 (toll-free from the U.S.), +852-3051-2780 (local dial-in from Hong Kong), 400-6322-162 (toll-free from Mainland China) or +1-646-254-3697 from international locations. The passcode for the replay is 6095653. A webcast replay will also be available on the investor relations section of Canadian Solar’s at www.canadiansolar.com.