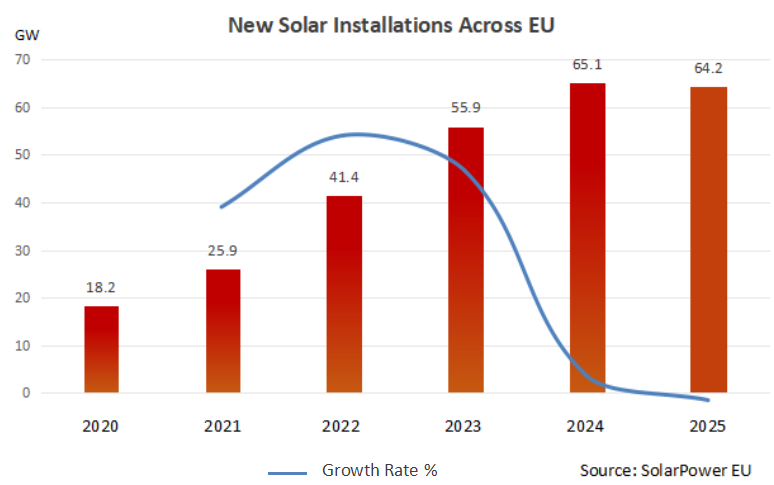

PVTIME – According to SolarPower Europe’s (SPE) mid-year report, the EU solar market is set to experience its first period of stagnant growth in a decade in 2025. This will be characterised by a decline in the residential sector and increased fragmentation in ground-mounted projects. The latest mid-year report by SPE indicates that new solar installations across the EU’s 27 member states are expected to total 64.2GW in 2025, marking a 1.4% year-on-year decline from the projected 65.1GW in 2024. This will be the first annual decline in the EU PV market since 2010. Although the total annual installed capacity is expected to exceed 400GW at 402GW, the structural contradictions behind the slowing growth have raised significant concerns within the industry.

The momentum of the solar PV industry has weakened over the past 18 months. After growing by 47% in 2022 and 51% in 2023, growth slowed to 3.3% in 2024. This shift signifies the EU PV market’s transition from explosive, crisis-driven growth to a critical phase of policy-market synergy. Though numerically small, the slight decline in 2025 carries profound symbolic weight, indicating the end of unbridled expansion fuelled by external crises and the beginning of a period that requires more robust policy frameworks and market-driven mechanisms.

The decline in the residential market in 2025 is mainly due to its legacy of ‘subsidy dependence’. A surge in energy prices and gas supply shortages, triggered by geopolitical tensions in Eastern Europe in 2022, led to a boom in EU residential PV, with European households installing solar systems to protect themselves against price volatility and blackouts. This underpinning factor drove rapid market growth between 2022 and 2023. However, as energy prices stabilised and gas supplies were restored, the residential market lost momentum due to a lack of long-term policy support.

Data shows that in traditional strongholds such as Italy, the Netherlands and Austria, new residential rooftop PV installations fell by over 60% in 2025 compared to 2023, primarily because subsidies were withdrawn without alternative measures being implemented. Major markets such as Poland, Germany and Spain also saw declines of over 40%. SPE analysis notes that reduced household sensitivity to price fluctuations, coupled with absent policy support, froze installation demand directly. This highlights the residential sector’s ‘path dependence’ on short-term subsidies: the 2022 REPowerEU-driven boom was not sustainable, and the market slumped once the dividends of the crisis faded. This underscores the sector’s vulnerability to external factors and the urgent need for stable, forward-looking policies to sustain growth.

In stark contrast to the sluggish residential market, large-scale, ground-mounted PV projects have emerged as the market’s ‘stabiliser’. The report forecasts that ground-mounted projects will account for 50% of new installations in the EU in 2025, driven by optimised national tender mechanisms and ‘PV+storage’ integration policies. In 2024, EU ground-mounted PV tender awards reached a record 20GW, led by Germany, the Netherlands, France and Italy. This trend continued into 2025: for example, a recent German tender for storage-linked PV projects received applications totalling three times the planned capacity, reflecting a strong national commitment to combining renewables and storage. SPE emphasises that tender optimisations, such as mandatory storage bundling and streamlined approvals, are key to maintaining the resilience of ground-mounted projects. These projects provide stable installation growth and drive innovation in renewables-storage integration, laying the foundations for a more sustainable and flexible energy landscape.

However, the weakening of corporate power purchase agreements (cPPAs) has cast a shadow over short-term market performance: cPPAs once drove large-scale ground-mounted development, with signing volumes peaking at 7GW in 2024. However, falling electricity prices in 2025 dampened buyer enthusiasm for long-term contracts, with new solar PPA signings dropping by 41% between Q1 and Q2. Although cumulative signings exceeded 20GW, SPE stresses that uncertainty in long-term commitments induced by price volatility may threaten the stability of investment in ground-mounted projects. This requires clearer policy frameworks to boost market confidence. These fluctuations reflect corporate investment sensitivity to market conditions and highlight the need for stable, predictable environments for long-term energy contracts.

On 22 July, the European Commission announced the launch of a second anti-dumping and anti-subsidy sunset review investigation into solar glass from China. Initiated by GMB Glasmanufaktur Brandenburg GmbH (GMB), Europe’s last large-scale solar glass manufacturer, and its affiliates, the investigation aims to assess whether lifting existing anti-dumping duties (17.5%–75.4%) and countervailing measures would result in continued harm to EU industry from Chinese products. This development not only prolongs over a decade of Sino-EU PV trade disputes, but also reflects the deep-seated tensions between protectionism and industrial competitiveness amid the global energy transition.

EU trade restrictions on Chinese solar glass date back to 2013, when the EU launched its first dual investigation, citing ‘market disruption’, and imposed anti-dumping duties of 0.4–36.1% in 2014. A 2015 anti-subsidy ruling drastically increased these rates to 17.5%–75.4%. Despite repeated price undertaking agreements by Chinese PV firms to secure breathing space, the EU maintained these rates for five years following its first sunset review in 2019, concluding in 2020.

The second review covers the period from 1 July 2024 to 30 June 2025, with the injury investigations tracing back to 2022. The European Commission claims that it needs to re-evaluate whether Chinese products are still being dumped and subsidised, and whether they still pose a threat to EU industry. Notably, GMB, whose petition prompted the investigation, filed for insolvency with a German court on 4 July 2025. As Europe’s last large-scale solar glass producer, GMB had a production capacity of 350 tonnes per day, supplying European firms such as the Swiss module manufacturer Meyer Burger. Its collapse signifies the complete disappearance of Europe’s PV supply chain. German firm Schott Solar and French firm Saint-Gobain exited solar glass production long ago, and multinational giants such as AGC and Guardian have no dedicated production lines in Europe either.

GMB’s Indian parent company, Borosil Renewables, attributed its insolvency to the impact of low-cost Chinese solar modules. It is estimated that China exported almost 200GW of solar modules to Europe between 2023 and 2024, accounting for 40% of its total exports that year. However, industry analysis suggests that the cost advantages of Chinese PV technology stem from synergies between large-scale production, technological development and integrated supply chains. For example, China’s industrial clusters have reduced production costs to less than a third of European levels across the entire chain, from polysilicon to modules. Meanwhile, the EU’s long-standing lack of policy support for domestic manufacturing has made firms uncompetitive.

Although EU trade restrictions are presented as safeguards for the domestic industry, their effectiveness is widely questioned. While EU PV installations continued to rise, reaching 68GW in 2024, domestic module production only met around 15% of demand, with the remainder being imported. On the other hand, high tariffs increase the cost of European PV projects, delaying the energy transition. Germany’s Solar Association (BSW) warns that escalating trade barriers could cause Europe to miss a critical window in the global clean energy race.

In terms of target achievement, the EU is on track to meet its short-term goals. Building on consecutive growth of +47% in 2022, +51% in 2023 and +3.3% in 2024, cumulative installations are projected to reach 402GW by 2025, surpassing the REPowerEU target of 400GW (DC) for that year. However, the strategic goal of 750GW (DC) by 2030 faces challenges. SPE forecasts that cumulative capacity will only reach 723GW by 2030, leaving a 27GW gap. In order to meet this target, the EU will need to achieve an average of 69.6GW of new installations each year after 2025, which is significantly higher than the projected 64.2GW in 2025. This gap highlights the need for accelerated action to address growth impediments such as policy uncertainty and market volatility.

The industry has clearly called for stronger policy support. SPE Deputy CEO Dries Acke acknowledges that, although the 1.4% decline in 2025 is modest, it signals a reversal in PV’s accelerating momentum. He argues that solar power could address energy security, price competitiveness and climate goals simultaneously, but the current lack of policy is undermining market potential. SPE Executive Advisor and Head of Market Intelligence, Michael Schmela, adds that the key to sustaining Europe’s PV success and meeting the 2030 renewable energy targets is clear: scaling up energy storage rapidly and enhancing power system flexibility. There is widespread agreement in the industry that the EU must refine its electrification policies, optimise storage mechanisms and stabilise cPPA environments in order to transition from ‘crisis-driven’ to ‘sustainable’ PV growth. This transition is essential for closing the long-term target gap and establishing PV as the EU’s second-largest power source. By 2024, solar generation had already surpassed coal (according to Ember data), saving the EU €59 billion in fossil fuel imports.

In summary, the slight decline in EU PV installations in 2025 reflects a transition from crisis-driven growth to market-driven growth, as well as the fading of crisis dividends. While the resilience of ground-mounted projects contrasts sharply with the residential slump, policy framework improvements and storage development will be pivotal in meeting long-term PV goals. During this pivotal period, the EU must adopt balanced strategies that address the needs of both residential and ground-mounted projects, supported by robust policies and market incentives, to ensure the continued growth of PV. Despite significant challenges, the EU can overcome hurdles and achieve its renewable energy targets with appropriate strategies, paving the way for a more sustainable and energy-secure future.

Scan the QR code to follow PVTIME official account on Wechat for latest news on PV+ES