PVTIME – On 1 April 2026, China’s Ministry of Finance and State Taxation Administration will cancel the value-added tax (VAT) export tax rebate for PV and other products.

This is the second major policy adjustment in over a year and has drawn intense attention across the industrial chain. Markets reacted swiftly: PV and battery enterprises have re-evaluated their production and export plans, while industry associations and research institutions have analysed the short-term impact on exports and the long-term impact on the industry.

Export tax rebates have long supported China’s PV exports and global market share by reducing export costs and boosting competitiveness. However, amid falling global PV prices, fierce market competition, phased PV overcapacity in China, and rising overseas trade barriers, the need for policy adjustments has become more urgent, making the cancellation of rebates an inevitable step towards industrial upgrading.

The announcement clarifies the specific adjustments: PV rebates will be fully cancelled by 1 April 2026, while battery rebates will drop from 9% to 6% between April and December 2026 before being fully cancelled by 1 January 2027. This provides enterprises with a buffer period to adapt.

China’s PV export tax rebate policy, launched in October 2013, has driven the industry’s global expansion. Over the past two years, these rebates have gradually been cut. From 1 December 2024, the rate for PV silicon wafers, cells, and modules fell from 13% to 9%, marking a transition towards full cancellation.

These rebates were a key source of profit for PV enterprises, particularly those in the mid- and downstream module manufacturing sector. Currently, rising upstream prices and slow-moving module price increases are squeezing margins, making rebates more critical. Their cancellation marks the end of the ‘export subsidies’ era and will reshape the industry by eliminating high-cost, inefficient production and promoting high-quality, market-oriented development.

Polysilicon: Short-Term Boost, Long-Term Pressure

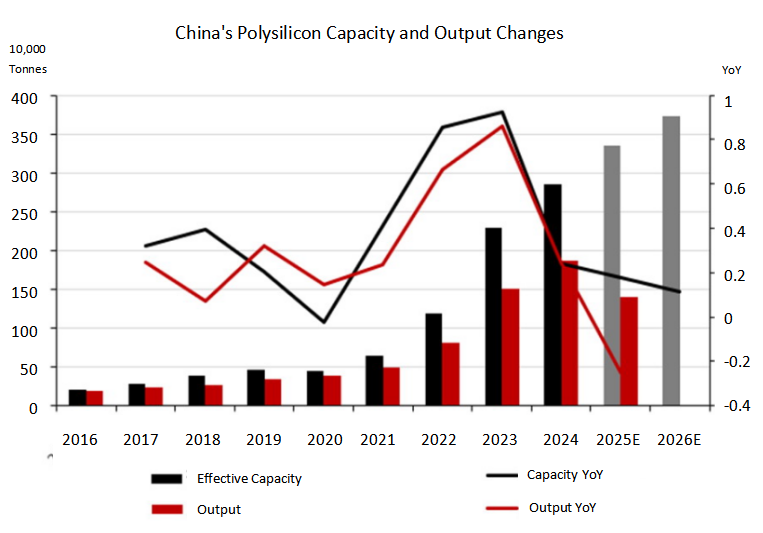

As a core upstream raw material in the PV industry, polysilicon is directly impacted by policy. It is currently facing short-term demand front-loading due to ‘rush exports’, as well as long-term pressure from weakened overseas demand. From 1 April 2026, the cancellation of PV rebates will increase module export costs by 8–10%, putting pressure on the polysilicon sector and affecting demand expectations.

This adjustment is not merely tax optimisation; it is a systematic restructuring of China’s PV export model in the context of overcapacity and rising trade barriers. It encourages enterprises to reduce their reliance on subsidies, improve their core competitiveness, and adapt to fierce global competition.

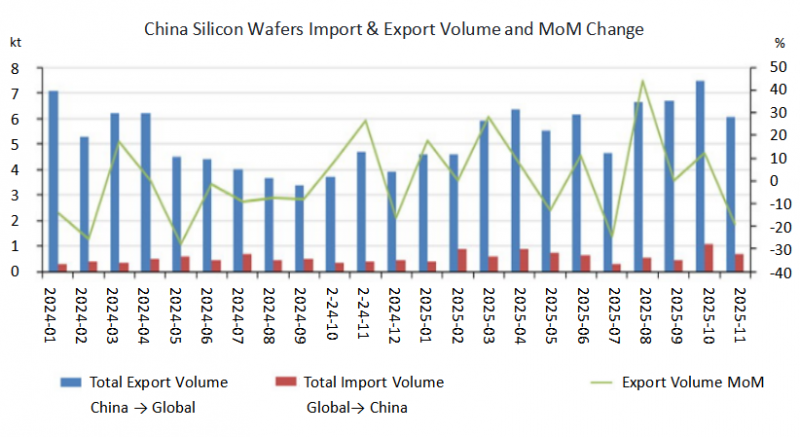

Tax rebate adjustments have a limited short-term impact on PV module exports. Exports reached 520 million units in 2024, rising slightly to 530 million in 2025 following the rebate cut in December 2024. However, there may be a surge in exports before 1 April 2026, with enterprises accelerating the delivery of overseas orders to avoid cost increases.

Leading module makers with overseas production and sales networks will be less affected, as these offset cost pressure. In contrast, small and medium-sized exporters with high costs will face greater pressure and potential market exit risks.

Policy expectations may prompt global module enterprises to place orders centrally in Q1 2026, which would boost China’s polysilicon procurement by 20% month-on-month compared to Q4 2025. Leading module manufacturers may stockpile polysilicon for over six months to secure costs, which could lead to a temporary shortage in the spot market and a short-term price increase.

However, the intensity of ‘rush exports’ remains uncertain. Overseas markets have already replenished inventory, limiting additional order demand. Additionally, the transmission of cost pressure to polysilicon may weaken as the market shifts back to cost pricing amid loose fundamentals, which will prevent sustained price gains.

In the long term, the cancellation of rebates will put pressure on the fundamentals of the polysilicon market. Higher overseas PV procurement costs will suppress global new installed capacity, while China’s polysilicon capacity will exceed 3 million tonnes by 2025, exacerbating the supply-demand imbalance. Overseas module purchases may drop by 10–15% in 2026, with cost-sensitive US and EU markets experiencing steeper declines and emerging markets reducing China’s market share through localised procurement.

Industrial Silicon: Dual Supply-Demand Pressure

Industrial silicon, a core polysilicon raw material, relies on PV for 50% of its demand, making it vulnerable to PV policy adjustments. It will face long-term pressure on both the supply and demand sides, with short-term support from PV ‘rush exports’.

Despite the fluctuation of PV module exports in 2025, the “rush exports” of late 2025 and early 2026 will encourage module enterprises to accelerate shipments, thus boosting the replenishment of polysilicon inventory and industrial silicon procurement. This will support industrial silicon demand in Q1 2026, alleviating inventory pressure from earlier overcapacity.

However, this Q1 demand boost is only temporary and does not represent a fundamental improvement. Once ‘rush exports’ end, demand for industrial silicon will return to weak fundamentals, putting pressure back on the market.

In the long term, industrial silicon faces overcapacity and slowing demand. Global PV installed capacity growth will slow down and curb industrial silicon demand. Meanwhile, 4 million tons of new capacity will be added between 2024 and 2026, which will exceed PV silicon demand growth and keep supply loose with low capacity utilisation.

Non-PV sectors (organosilicon and aluminium alloys) are growing slowly with limited demand elasticity due to weak real estate and slow automotive lightweight substitution. This will fail to offset PV demand gaps. Industrial silicon inventory continues to accumulate, exacerbating market pressure.

Prices of industrial silicon have fallen by almost 40% from their 2024 highs and are approaching the cash cost lines of high-cost enterprises by late 2025. Although industry integration will accelerate and eliminate inefficient capacity, loose supply will persist, putting downward pressure on prices and compressing enterprise profits.

Lithium Carbonate: Limited Long-Term Impact

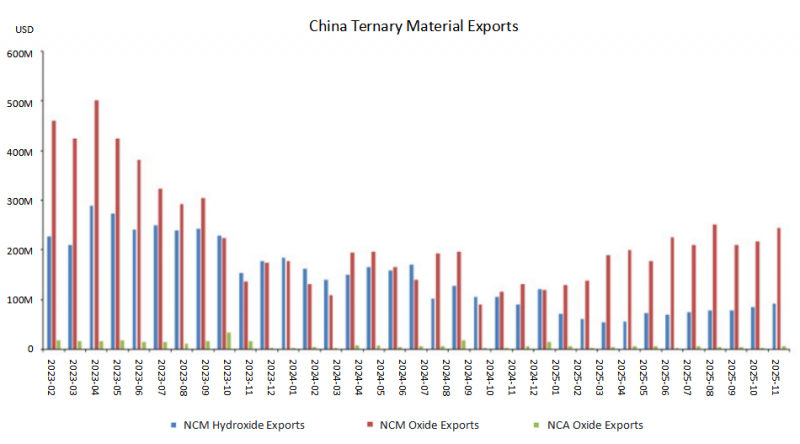

Unlike PV products, battery rebates are cancelled gradually over a buffer period, resulting in a ‘short-term boost and limited long-term impact’ on lithium carbonate. The announcement cuts battery rebates to 6% between April and December 2026, before cancelling them in 2027, following a cut from 13% to 9% in 2024.

The 2024 cut to battery rebates boosted exports of most cathode materials in 2025 (e.g. lithium iron phosphate and lithium nickel cobalt manganese oxide), with only exports of lithium hexafluorophosphate declining slightly. Analysts attribute this to ‘rush exports’ and strong overseas EV demand, which may further increase exports in 2026.

However, rebate cuts will increase battery export costs and squeeze profits. Between January and November 2025, China exported 2.382 billion lithium batteries (+8.14% year on year), with over 40% going to major markets such as Europe, the US, Japan and South Korea. These markets have local battery industries, but they have higher production costs.

China’s production costs are 20%-30% lower than those in these countries thanks to large-scale production and complete supply chains. Asian countries without local battery industries will absorb the cost increases, which will keep China’s cells competitive.

In Q1 of 2026, the rush to export cells will briefly boost lithium carbonate prices, albeit to a lesser extent than polysilicon due to the buffer period. Enterprises will have more time to adapt, reducing the need for large-scale rush exports.

In the long term, cuts to rebates will have a limited impact on lithium carbonate prices. They will eliminate obsolete battery production capacity and improve industrial concentration, while the ongoing development of electric vehicles (EVs) will support long-term demand for lithium carbonate. Ultimately, prices will depend on fundamental supply and demand.

Scan the QR code to follow PVTIME official account on Wechat for latest news on PV+ES