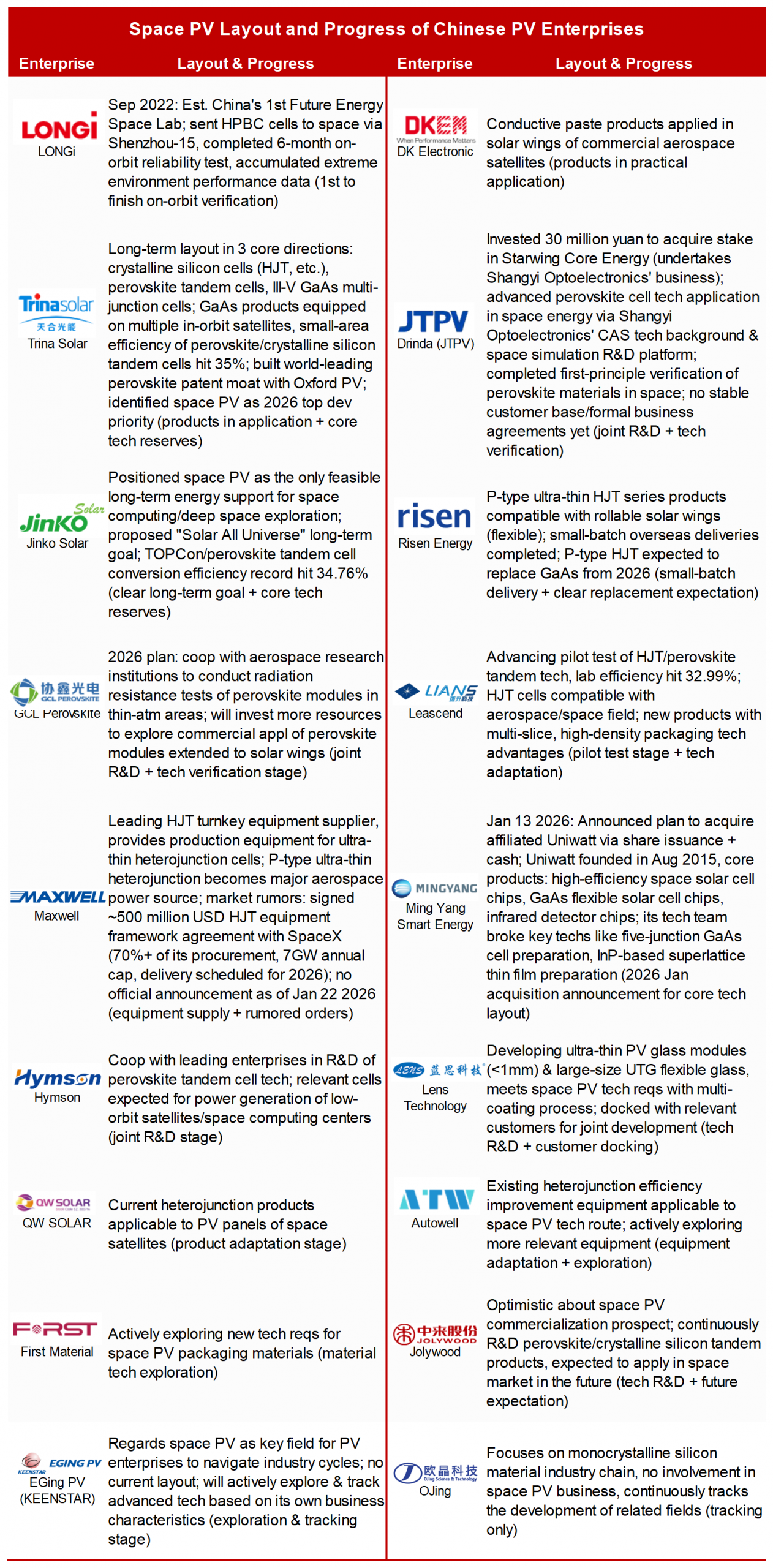

PVTIME – Interest in space PV power has surged to unprecedented levels since the beginning of 2026. Emerging as a trillion-dollar market sector, it has captured the attention of capital markets, driven by strategic moves from industry leaders such as the Chinese PV manufacturers Jinko Solar, Trina Solar, Drinda(JTPV) and so forth.

This momentum was further amplified when Elon Musk spoke about the future of space PV in an early 2026 public interview, stating that solar energy was the only pathway to human energy freedom and proposing a plan to deploy solar AI satellites designed to maximise the benefits of 24-hour sunlight in space via 8,000 launches each year. At the World Economic Forum Annual Meeting on 22 January, Musk reaffirmed his strong support for space PV and shared key production capacity plans. He noted that the development of space AI computing centres is a logical step, and that SpaceX and Tesla are collaborating to increase solar manufacturing capacity to 100GW per year within three years.

Space PV is not a new concept. In the early days of photovoltaic power generation, its high costs meant it was first used in the relatively price-insensitive aerospace sector. In 1958, the United States’ second artificial satellite was launched into space with both chemical and photovoltaic cells on board, paving the way for the use of PV cells in aerospace applications.

SolaEon was one of the first companies to conduct on-orbit space PV tests, sending perovskite modules into a 535-kilometre orbit for such trials via the Ceres-1 rocket in May 2024. Since then, the company has continued to advance ground simulation tests and space environment field trials, establishing partnerships with several aerospace technology firms, including Galactic Power Aerospace. On 30 December 2025, Drinda(JTPV) announced a strategic collaboration with Shangyi Optoelectronics centred on the use of perovskite cell technology for space energy. The company also noted that the low-orbit satellite sector alone is set to reach a trillion-yuan output value.

The pace of strategic planning for space PV among Chinese enterprises accelerated significantly in 2026. On the evening of 12 January, Ming Yang Smart Energy, a leading wind turbine manufacturer, announced plans to acquire Uniwatt, which the market interpreted as the company’s entry into the space PV sector. Uniwatt specialises in products including space and flexible solar cells, and has full research, development and manufacturing capabilities along the entire industrial chain. Then, on 14 January, Drinda(JTPV) revealed more details of its space PV strategy. The company proposed investing 30 million yuan in cash to acquire a 16.6667% equity stake in Starwing Core Energy, by subscribing to 461,500 yuan of its newly increased registered capital. This will make Drinda the company’s second largest shareholder. The two parties will also establish a joint venture dedicated to producing CPI films and CPI film-silicon cell integrated products, advancing their presence in low-orbit and space PV. On the same day, Trina Solar’s National Key Laboratory of PV Science and Technology set a new world record with an output of 886 W for a large-area perovskite/crystalline silicon tandem module measuring 3.1 square metres, and achieved a major breakthrough in the research and development efficiency of perovskite/P-type HJT tandem cells. On 15 January, Jinko Solar confirmed that it is advancing the R&D of AI-based, high-throughput perovskite tandem solar cells and projects to achieve meaningful-scale mass production within approximately three years.

GCL Perovskite has outlined plans to collaborate with aerospace research institutions in 2026 to test the radiation resistance of perovskite modules in areas with a thin atmosphere. The company intends to invest more resources in the future to explore the commercial application of extending perovskite modules to solar wings. Risen Energy claims that its P-type ultra-thin HJT series products offer significant advantages in terms of ultra-thin silicon wafer application and radiation resistance. These products are compatible with rollable solar wings and have already been delivered in small batches to overseas markets. Industry institutions and enterprises widely anticipate that P-type HJT will begin to replace gallium arsenide in 2026.

To date, almost 20 PV enterprises in China have developed space PV strategies.

However, Ginlong (Solis) and Hoymiles have not yet launched any space PV products and are merely monitoring industry developments. Meanwhile, JA Solar, TCL Zhonghuan, TBEA and APsystems has no current plans to enter the space PV sector, but is keeping a close eye on cutting-edge technological trends in the field.

The extensive presence of Chinese enterprises and the strong support of the capital market for space PV stem from the technology’s broad development prospects and practical market demand. Commercial aerospace technology is becoming increasingly sophisticated, and the value of the space economy is being continuously explored, providing a solid foundation for the development of space PV. Meanwhile, the development of space computing has attracted widespread attention, with overseas giants such as SpaceX and Google planning to build space data centres. Space PV is recognised as a stable, high-efficiency energy source for such facilities. In space, traditional fossil fuels have significant disadvantages, including high storage risks and complex supply chains. Nuclear energy is also not suitable for large-scale application due to its technical complexity and stringent safety requirements. In contrast, PV technology directly converts solar energy into electricity, offering the core advantages of sustainability, stability, and lightweight design. This makes it ideally suited to meeting energy demands in extreme space conditions.

Perovskite and its tandem technology have emerged as the leading technical options for space-based PV. The main routes currently under development include gallium arsenide, crystalline silicon and perovskite, with the latter favoured by many institutions and companies. According to Opticore Technology, gallium arsenide cells offer high efficiency, strong radiation resistance and good high-temperature stability, but are costly, use scarce raw materials and are inflexible. Although crystalline silicon cells offer the advantages of low cost, relatively high power generation efficiency and a mature industrial chain, they exhibit poor radiation resistance in space and a rapid decline in photoelectric conversion efficiency. Perovskite cells, however, offer high efficiency, good radiation resistance and a low temperature coefficient, and can be manufactured to be lightweight and flexible. Although their stability requires improvement and their long-term performance in extreme space environments remains to be verified, perovskite is still the preferred technical route for the future of space PV, expected to account for over 70% of the market. GCL Perovskite shares this view, noting that iterative upgrades to perovskite technology will enable it to match the performance of gallium arsenide in space at just one percent of the cost. Compared with crystalline silicon cells, perovskite cells also offer distinct advantages in terms of efficiency and flexibility of application, making them a more promising photovoltaic material for future mass low-orbit satellite constellations. Both Jinko Solar and Trina Solar have identified perovskite tandem technology as a key R&D priority: Jinko Solar views it as the optimal long-term solution for space PV, while Trina Solar has already achieved leading R&D results in related technologies.

Relevant industry research reports have made predictions regarding the technical development and commercialisation timeline of space PV. Among existing mass-produced technologies, P-type HJT cells offer the most notable advantages in terms of radiation resistance and lightweight design, and their penetration rate is expected to rise from 2026, primarily for low-orbit, short-term, low-cost and low-power missions. From 2028, perovskite and its tandem cells are expected to gradually take on tasks for low-orbit constellations and deep space exploration. According to Wang Jian, an analyst at TrendForce, large-scale commercial ground power supply via space PV will not be realised until after 2040.

Enterprises have also established clear development plans for their space PV strategies. Opticore Technology points out that the rollout of space PV cannot be achieved in a single step, but must be advanced in phases according to specific scenarios. The short-term core goal is to address satellite power supply challenges, while the long-term objective is to transmit space energy back to Earth. The company confirms that it is still in the critical phase of technical verification, primarily focusing on completing on-orbit testing of perovskite modules before progressing to the commercial application stage. GCL Perovskite states that it will focus on existing demand and predictable low-orbit application scenarios, as well as relevant partners. The company plans to accumulate engineering data and complete product verification by participating in on-orbit testing and ground simulation tests, and by developing standardised processes. Mass production will be advanced in line with market development. Jinko Solar projects that it will achieve the mass production of perovskite tandem cells on a meaningful scale within approximately three years.

Despite its promising prospects, the commercialisation of space PV faces numerous practical challenges and potential risks that require careful consideration. In terms of cost, an industry insider has calculated that achieving an annual production capacity of 100GW would result in module costs alone reaching hundreds of billions of US dollars, not to mention the exorbitant launch, construction, and on-orbit maintenance costs. Launching a single satellite fitted with PV arrays already costs hundreds of thousands of US dollars, which makes production and deployment economically unviable. Technically, the space environment poses multiple challenges, including temperature cycles of around ±150°C, high-energy radiation, and atomic oxygen erosion. PV equipment must withstand an extreme temperature difference of 300°C, which severely impacts cell lifespan. Furthermore, the long-term stability of perovskite cells requires verification.

Enterprises also need to be aware of the risks associated with technical uncertainty. In its announcement, Drinda mentions that the company has no technical experience in adapting to space scenarios or integrating aerospace resources, and that this external investment may face multiple technical uncertainties, including underperforming R&D and unclear technical routes. Personnel at Jinko Solar also state that the large-scale commercial application of space PV is still constrained by factors including the availability of raw materials and the complexity of production processes.

Overall, space PV is in the early stages of commercial exploration. Against a backdrop of intensive strategic planning by industry giants, only time will tell whether it represents the emergence of a new industrial boom or merely a hype cycle in the capital market.

Scan the QR code to follow PVTIME official account on Wechat for latest news on PV+ES