PVTIME – China’s Ministry of Commerce has announced the final ruling on the anti-dumping measures for imported solar-grade polysilicon from the United States and South Korea, which came into force on 13 January.

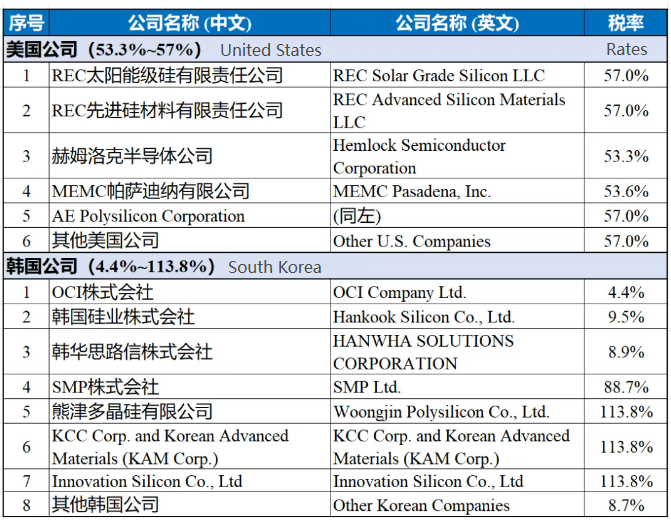

The review process began on 10 January 2025, when the Ministry of Commerce launched a final review investigation in accordance with Article 48 of China’s Anti-Dumping Regulations, commencing a formal investigation on 14 January 2025. Anti-dumping measures were first introduced in 2014, following severe harm to China’s photovoltaic industry caused by the low-cost dumping of solar-grade polysilicon from the US and South Korea. The Ministry of Commerce issued Announcement No. 5 of 2014, imposing duties ranging from 53.3% to 57% on US companies, and from 2.4% to 48.7% on South Korean companies, for a period of five years.

In 2017, the Ministry adjusted the duty rates for South Korean imports to a range of 4.4% to 113.8% via Announcement No. 78 of 2017. As the measures neared expiration, Announcement No. 1 of 2020 extended them for a further five years. In May 2020, Announcement No. 21 transferred the tariff-related rights and obligations of Hanwha Chemical to Hanwha Solutions.

Thirteen domestic polysilicon producers, including Sichuan Yongxiang, submitted a review application by 2024, when the measures were due to lapse. They argued that terminating the duties could lead to renewed dumping and subsequent harm to the domestic industry, and requested that the Ministry maintain the existing measures. Following a comprehensive review of the applicants’ eligibility, product comparisons, import data, and supporting evidence, the Ministry confirmed that the application met the requirements for a final review. Based on this recommendation, the State Council’s Tariff Commission decided to retain the existing duty scope and rates outlined in the 2014, 2017, and 2020 announcements during the review period.

As of the end of 2024, current US-based polysilicon production capacity includes 20,000 tonnes from Wacker Polysilicon and 30,000 tonnes from Hemlock Semiconductor. REC Silicon’s 16,000-tonne granular polysilicon plant in Washington State closed in 2019, and its acquisition by South Korea’s Hanwha Group in July 2025 triggered litigation that forced the suspension of production. Hemlock’s Tennessee plant was acquired by Corning in 2024, who committed to restarting over 80 per cent of the plant’s capacity within five years.

South Korea’s OCI operates a 35,000-tonne solar-grade polysilicon plant in Malaysia, and its subsidiary, OCI TerraSus, is partnering with Japan’s Tokuyama to build a semiconductor-grade facility in Sarawak, which is set for completion in the first half of 2027. Meanwhile, Japan’s Toyo Solar has recently signed a one-year contract with an unnamed US producer for domestically manufactured polysilicon. As the global polysilicon landscape undergoes profound restructuring, the market is bracing itself for potential shifts amid evolving policy and industry dynamics.

Scan the QR code to follow PVTIME official account on Wechat for latest news on PV+ES