PVTIME – As the global energy transition enters a critical phase, the rate at which PV technology evolves directly affects the speed at which clean energy is adopted. Perovskite solar cells, a leading third-generation PV technology, have experienced explosive growth in efficiency and production capacity in recent years. Their distinct performance advantages are reshaping the PV industry, with the technology progressing from laboratory breakthroughs to large-scale manufacturing and emerging as a key driver of change in the global energy landscape, spearheaded by Chinese enterprises.

Efficiency: From Laboratory Records to Industrial Viability

The greatest competitive strength of perovskite cells is their continuously improving photoelectric conversion efficiency. This is supported not only by laboratory data, but also by the technical foundations required for industrial use. This progress stems from dual innovations in material properties and technical processes that have surpassed the performance limitations of traditional silicon-based cells.

In September 2025, an international research team published findings in Science showing that perovskite-silicon tandem cells had reached an efficiency of 33.1%, surpassing the 29.4% theoretical limit of silicon cells and bringing them closer to the 43% theoretical ceiling for tandem technology. Corporate R&D has also delivered strong results: JinkoSolar’s perovskite tandem cells with N-type TOPCon bottom cells reached 32.33% efficiency, while Trina Solar’s 210 mm large-format tandem cells exceeded 31.1%. Tongwei’s tandem cells also achieved 31.13% efficiency. Even single-junction perovskite cells have achieved efficiencies of over 26% in laboratories, closing the gap with silicon cells’ laboratory record of 27.6%.

Key technical advances underpin these gains. The pyramid-shaped texture of traditional silicon cells enhances light absorption, yet complicates the deposition and passivation of perovskite films. New research uses 1,3-diaminopropane dihydroiodide as a passivation material to solve surface treatment challenges for complex structures, while also improving conductivity and fill factor. In terms of material stability, a team from East China University of Science and Technology has proposed a graphene-polymer reinforcement solution that offers a new approach to addressing perovskite degradation. These innovations have transformed perovskite cells from ‘high-potential’ to ‘commercially viable’, paving the way for increased production capacity.

Capacity: Scaling from MW pilots to GW production

While efficiency breakthroughs are perovskite technology’s ‘offensive edge’, capacity expansion is its ‘defensive shield’ for achieving market penetration. Between 2024 and 2025, the perovskite industry made a critical leap from MW-scale pilot production to GW-level mass manufacturing, with the industrial ecosystem maturing rapidly.

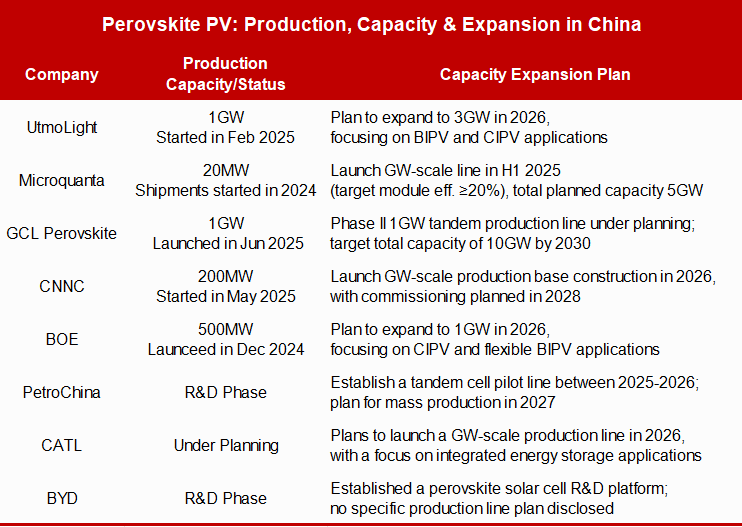

Leading firms are setting the pace for capacity growth. In February 2025, UtmoLight, an innovative high-tech enterprise specializing in the research, development and manufacturing of perovskite photovoltaic and photoelectric products, completed and commissioned the world’s first GW-level perovskite production line, producing 2.8 m² large-format modules with 16.1% efficiency. GCL Perovskite has adopted a more aggressive strategy: its planned 2GW line, including 1GW of single-junction capacity and 1GW of tandem, is set to start operations in 2025. Its 2 m² single-junction modules have achieved steady-state efficiency of 19.04%. Meanwhile, Microquanta Semiconductor, a globally recognized leader in perovskite photovoltaic technology and industrialization, headquartered in Hangzhou of China, has made significant progress in developing large-format modules, with 810 cm² modules achieving 21.86% efficiency. It is the world’s first company to achieve mass production of third-generation perovskite solar modules. Its GW-level production line is now set to increase the efficiency of 2.88 m² modules to above 20%.

Cross-industry giants are accelerating industrial maturity by entering the sector. Energy and technology leaders, including PetroChina, CNNC, CATL, BYD and BOE, have launched pilot line construction projects. BOE has bypassed small-format products entirely by commissioning a 1 m × 2 m large-format module line, becoming the first to achieve GW-level mass production capabilities. According to China Huaneng Group, over 60 Chinese enterprises now produce perovskite modules, with four GW-level production lines under construction, and total industry financing exceeding two billion yuan. Globally, perovskite mass production capacity is expected to reach 1.5GW by 2025, surpassing 2GW by 2026, with China accounting for over 65% of this.

Capacity growth is paired with process optimisation rather than simply replicating existing processes. The industry has shifted its focus from small-format ‘champion modules’ to scaling up and ensuring the feasibility of mass production. Pilot lines now achieve efficiencies of 18–19%, with over 60% localisation of key equipment. Suzhou SC Solar, a pioneer in the manufacture of intelligent equipment for the solar industry, its fully automatic slot-die coaters have increased yields to 92% with RPD equipment achieves deposition rates of 15 nm/s and laser scribing precision of ±5 μm. These improvements ensure stable perovskite manufacturing at GW level.

Core Advantages: Reshaping PV Competition

The rapid rise of perovskite cells reflects their comprehensive advantages in terms of cost, production and application. This enables them to compete with silicon cells and align more closely with future energy needs.

Cost is a key strength. A 1GW perovskite production line requires an investment of 500 million yuan, which is less than half of the 1 billion yuan needed for a silicon production line of the same scale. Production energy usage is around 0.12 kWh/W, which is only 8% of the 1.52 kWh/W used by silicon cells, thereby reducing lifecycle carbon emissions. Perovskites solar production also avoid reliance on scarce resources such as high-purity silicon, as their active layer is just hundreds of nanometres thick, significantly reducing the amount of raw materials required. The International Renewable Energy Agency calculates that the use of large-scale perovskite tandem cells could reduce the levelised cost of PV electricity to below $0.05 per kWh, representing a 40% drop. In 2025, perovskite module manufacturing costs fell to 0.8 yuan per watt, and it is expected that they will reach below 0.5 yuan per watt by 2030.

Production processes also offer advantages. While silicon cell manufacturing requires four separate facilities for silicon material, wafers, cells and modules, perovskite cells can be produced from start to finish in one factory, shortening lead times. Perovskite production lines can be built in 12–18 months, which is far faster than the 24–30 months required for silicon production lines. This enables a quick response to market shifts.

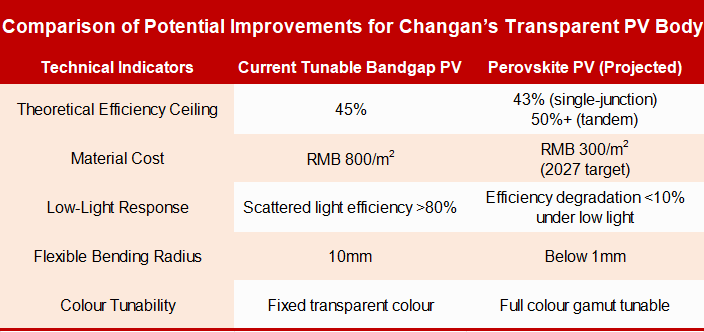

Diversified applications open up new markets. Thin, lightweight, flexible perovskite films are over 80% lighter than silicon cells and can be made into transparent or coloured modules, making them ideal for building-integrated photovoltaics (BIPV). Their strong performance in low light suits vehicle-mounted PV, maintaining efficiency on cloudy days or during sunrise and sunset. BYD is developing flexible perovskite cell technology with the aim of applying it to curved surfaces across entire vehicles in the future. This will achieve a breakthrough in daily charging, supporting a range of 200 kilometres. This follows the 2025 Han DM-i model, which features a HJT PV roof that generates enough power each day to drive 50 kilometres. The HJT PV roof option costs an additional 8,000 yuan and pays for itself within three years. Changan Automobile’s ‘transparent PV body’ integrates power generation with design, boosting annual range by up to 10,000 km. At the 2025 Smart China Expo, Changan Automobile revealed its plan to achieve full-body perovskite PV coverage by 2030, which will not only bring an improvement in conversion efficiency but also raise the target for annual range increase to 15,000 kilometres. Perovskites also show promise in mobile energy and aerospace applications. Shanghai Harbour has secured orders for five satellites with perovskite modules, delivering a net profit of 500,000 yuan per satellite.

If perovskite technology is adopted in the future, Changan Automobile’s Transparent PV-integrated Vehicle Body will see the following improvements:

Future Trends: Technology and Market Growth

From 2025 to 2030, the perovskite industry will experience accelerated technological development and market growth. The clear path forward involves focusing on tandem technology, leveraging application scenarios, and establishing robust standards to increase penetration of the PV market.

Tandem technology will drive medium-term development. Perovskite-silicon tandem cells offer high efficiency and stability, making them attractive to the market. The International Energy Agency predicts that they will account for over 70% of the perovskite market by 2030. The long-term focus will be on all-perovskite tandem cells, which offer higher theoretical efficiency and leverage the flexibility of perovskites for wearable devices and flexible PV. By 2025, mass-produced perovskite modules T80 had a lifetime of 3,000–5,000 hours (approximately 0.3–0.6 years), which was limited by material degradation and packaging issues. However, leading firms such as GCL Perovskite and UtmoLight have improved the lifetime to almost that of silicon cells by making adjustments to the materials used (e.g. adding caesium) and innovating in the area of packaging (e.g. using double-glass with organic silica gel). T80 lifetimes are expected to exceed 10,000 hours (approximately 1.2 years) by 2027, approaching the level of silicon cells.

The market scale will grow exponentially. China’s perovskite module market is expected to reach 15 billion yuan by 2025 and 45 billion yuan by 2030, while the global market could exceed 300 billion yuan. Global cumulative installed perovskite capacity is expected to exceed 150GW by 2030, with China accounting for 40% of this figure. This will generate enough power for 30 million households annually. Initially, penetration will occur in emerging areas such as BIPV and vehicle-mounted PV, before expanding to ground-mounted plants. Perovskites could capture 20–30% of the global PV market by 2030.

Ecosystem support will drive this growth. China has included perovskite in its key R&D catalogues for high-efficiency PV and will allocate 1.2 billion yuan of central government special funds for this purpose in 2025, thereby mobilising over 8 billion yuan of social investment. The development of standards is accelerating: the China Photovoltaic Industry Association is drafting durability standards (e.g. the Accelerated Aging Test Method for Perovskite PV Modules), and plans to include T80 lifetime in mandatory certification, shifting the industry from an ‘efficiency race’ to ‘efficiency and stability dual drivers’. The association has released six group standards, while TÜV Rheinland has launched the world’s first perovskite module certification programme, reducing testing cycles to three months. In terms of patents, Chinese firms filed 1,532 new perovskite-related patents in 2025, accounting for 43% of the global total. There is now a consensus in the industry around cross-licensing to encourage collaboration.

Challenges and Outlook

The perovskite industry is facing several challenges. Tight financing has left some start-ups short of funds for pilot lines, equipment integration needs improvement and long-term reliability requires validation outdoors. However, these are phase-specific issues in the commercialisation of technology, and they will likely be resolved as leading firms achieve economies of scale and technological advances.

The efficiency breakthroughs and capacity expansion of perovskite cells represent more than an upgrade to PV technology; they are a revolution in energy production. From laboratories to factories and from single-use power generation to a variety of applications, perovskites are propelling the PV industry from ‘scale expansion’ to ‘quality improvement’. With the backing of global Dual Carbon goals of China and ongoing technological maturation and ecosystem development, perovskites are set to become central to future energy structures and power the global energy transition. This PV transformation, spearheaded by Chinese enterprises, is ushering in a new era of clean energy.

Scan the QR code to follow PVTIME official account on Wechat for latest news on PV+ES