PVTIME – During the “2020 Photovoltaic Development Review and 2021 Outlook Conference” held this past Wednesday, BloombergNEF senior analyst Luan Dong gave a presentation on global photovoltaic development trends for 2021.

Luan Dong prefaced the presentation by mentioning that Bloomberg’s global market trend outlook is done quarterly. Since data from last year has not been fully updated, he would only be sharing the seven major trends BloombergNEF expects for the photovoltaic industry in 2021.

The global photovoltaic new installed capacity is expected to hit a record high in 2021

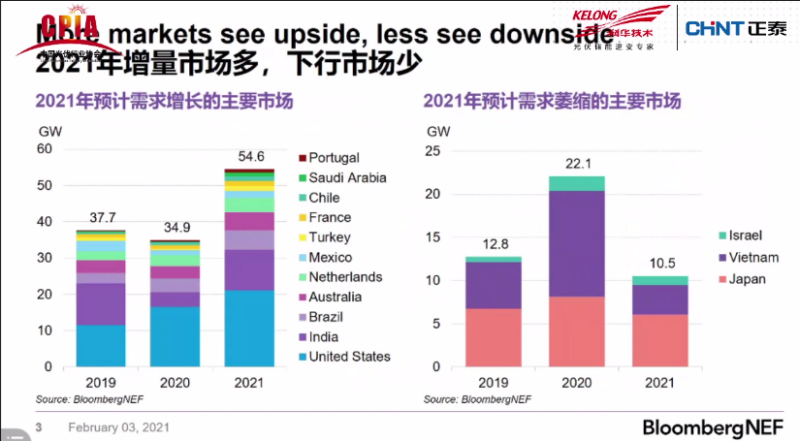

In 2021, the global installed capacity of photovoltaics is expected to exceed 150GW (194GW being the most optimistic prediction). Many major markets are expected to maintain a certain degree of growth while the number of markets that are expected to show decline is relatively low.

In addition to China, the United States, India, Brazil, Australia, the Netherlands, Mexico, Turkey, France, Chile, Saudi Arabia, and Portugal are expected to add a combined 34.9GW on top of their installed capacity last year due to increases in demand.

For the next five years, overall demand in the United States will exceed 80GW and residential photovoltaics will continue to grow at around 4-5GW per year. Industrial and commercial installations will stabilize at below 2GW each year, and the remaining will mainly come from utility-scale ground power stations.

The three largest shrinking markets in 2021 will be Israel, Vietnam, and Japan. The three will combine for a 10GW demand decrease, which is still the lowest in recent years.

Carbon neutrality goals will boost solar auctions

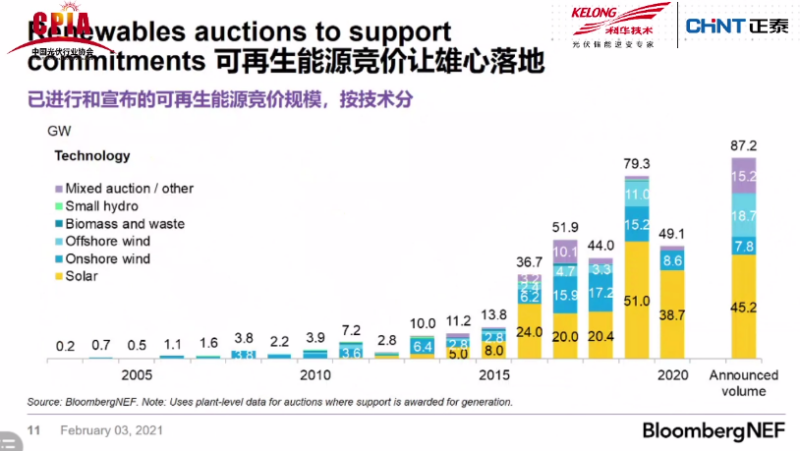

According to statistics, countries and regions that currently account for 42% of the world’s carbon emissions combined have committed to achieving carbon neutrality. Moreover, there are 68 other countries and regions that are currently discussing doing the same which would cover an additional 12% of the world’s carbon emissions.

The most direct and immediate way for countries to achieve their carbon neutral goals is hold renewable energy auctions. According to statistics, the combined capacity of announced planned auctions around the world has reached 87GW, of which 45GW will be photovoltaics, and 15GW will be hybrid. These auctions will provide a relatively stable increase in photovoltaics for major global markets in the future.

Grid access will continue to be the biggest challenge

Presently, the biggest constraints on the global growth of photovoltaic projects are grid connection and consumption and no longer economics or finance. Different markets compete for the resource that is grid access in different ways. Some are relationship-based, some are first-come-first-served, and other markets use bidding to make the process more transparent. Portugal is the most typical example of the latter. Last year, the world’s lowest bid appeared in Portugal.

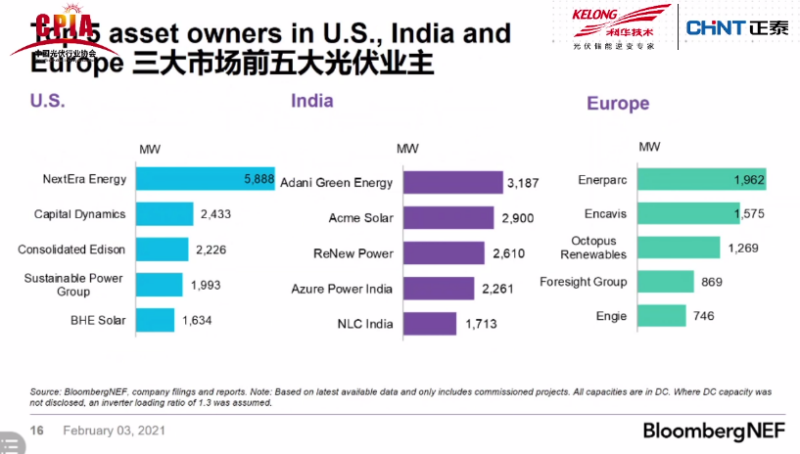

IPPs, utilities, and oil companies will be major developers and buyers of PV projects

Due to the complexity of project income, fixed electricity prices, market-oriented transactions, and uncertainty surrounding future electricity prices, global power station owners and purchasers have gradually shifted from relatively low-tech financial investors to IPPs, utility companies, and even oil companies with a deeper understanding of the actual operation and operation of the projects.

PV + hydrogen will drive demand for renewable energy

Globally, wind power and hydropower have taken the lead in the production of green hydrogen due to their higher utilization hours and stability of output. However, in places with good sunlight, due to the lower cost of electricity, the development of hydrogen energy has gradually opened the door to photovoltaics. BLoombergNEF expect that in the next two years, there will be more green hydrogen projects in the range of 10-20MW supported by photovoltaics. As of the end of 2020, there were about 50MW of electrolytic water hydrogen energy projects powered by photovoltaics in the world.

Large-sized and bifacial modules will continue to gain market share

The trend of large-sized and bifacial modules will continue this year. It is estimated that more than 40% of modules shipped globally in 2021 will have power ratings of over 500W.

PV glass prices will decrease as more capacity come online

The gradual expansion of photovoltaic glass production capacity this year will lead to price decreases.

Glass demand of 102GW for monofacial modules, 17GW for transparent backplanes, and 67GW for bifacial modules from the past two years equates to about 26000 tonnes/day in glass production capacity needed.

With effective production glass production capacity estimated to be close to 30,000 tonnes/day this year and 40,000 tonnes/day next year, supply should not be an issue.