PVTIME – On 5 February, Wang Bohua, Advisor to the China Photovoltaic Industry Association (CPIA), delivered a keynote speech at the Seminar on the 2025 Development Review and 2026 Outlook. Using detailed data, he provided a comprehensive review of the PV industry’s achievements and challenges between 2021 and 2025, and presented key market forecasts for the period from 2026 to 2030. He noted that the industry is shifting fully from scale expansion to value competition, and that the market is expected to recover steadily following a short-term correction.

The 2021–2025 period saw significant progress for China’s PV industry, with multiple core indicators reaching record highs. The manufacturing sector performed particularly strongly, achieving a peak annual output value (excluding inverters) of over 1.75 trillion yuan — four times higher than in the period 2016–2020. Export value reached 189.5 billion US dollars, doubling the total for the 2016–2020 period and covering 240 countries and regions. Cumulative installations surpassed 1,200 GW, entering the terawatt era. 80% of new installations were completed during the 2021–2025 period, with annual additions consecutively exceeding 100GW, 200GW, and 300GW, reaching 315GW in 2024.

Technological innovation remained the industry’s core driver. Comprehensive power consumption of polysilicon fell by 21%, comprehensive energy consumption by over 28%, and per capita output rose by 88%. In the silicon wafer market, the market share of N-type monocrystalline silicon jumped from single digits to 97% by 2025, with wafers measuring 182mm or larger accounting for almost 100% and tungsten wire accounting for over 90%. Solar cell volume production efficiency increased by over 0.4% each year, with TOPCon technology accounting for 87.6% of the market. Chinese research institutions broke the NREL laboratory efficiency record 27 times, accounting for 55% of the global total, which is double the figure for 2016–2020. Module power increased, with bifacial modules accounting for over 80% of the market and EPE film rising by 26.4%.

The application markets and exports also performed well. From 2021 to 2025, cumulative new installations were 4.5 times higher than from 2016 to 2020, and cumulative power generation was 3.6 times higher. From 2023 to 2025, annual additions exceeded the total for 2016-2020 for three consecutive years, with photovoltaic power accounting for 12.6% of total generation in 2025. Meanwhile, exports shifted from rapid expansion to structural adjustment, peaking at 51.2 billion US dollars in 2021–2022. Although exports fell by 8.3% year-on-year in 2025, the decline narrowed. The share of the top ten module export markets dropped from 72.6% to 49.6%, while GW-level export markets rose to 47%.

However, the industry faced phased challenges after 2023. A supply-demand imbalance caused sharp price falls across the industrial chain: polysilicon, silicon wafers, cells, and modules dropped by 76.3%, 82.8%, 71.1%, and 62.1%, respectively. This impacted the industry’s overall economic benefits, with the loss ratio widening in 2024 and resulting in significant industry losses in 2025. Manufacturing output value and export growth slowed markedly as production entered a correction period.

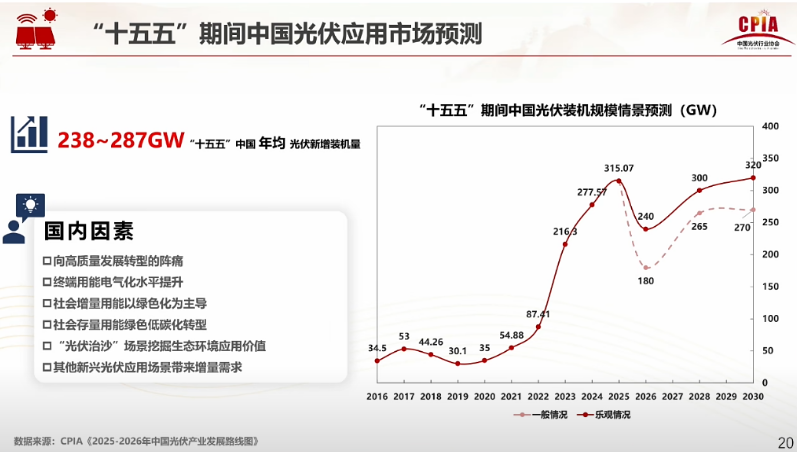

Looking ahead to 2026–2030, Wang Bohua forecasts that China will install 180–240GW of new PV in 2026, with global additions reaching 500–667GW. Fluctuations may occur due to previous rapid growth and major market policy adjustments, but long-term growth will persist. Rising demand in emerging markets such as India, the Middle East, and North Africa will drive a stable upward trend, with average annual global new installations expected to reach 725–870GW between 2026 and 2030.

Industrial transformation will see a shift from competing on scale and price to competing on value. The manufacturing sector will focus on three key areas:

1) Coordinated intelligence, covering R&D, production and power station operation.

2) Greenisation, promoting green production with green energy and carbon reduction.

3) Integration, deepening links between PV, energy storage, hydrogen and computing power.

Policies will curb vicious competition and phase out outdated production methods, meaning enterprises will need to develop technological advantages and accelerate the volume production of silver-free/low-silver technology and perovskite tandem cells.

Wang Bohua emphasised that the scale accumulation and technological progress of 2021–2025 laid a solid foundation for transformation, and that the phased adjustment of 2026–2030 is an inevitable step towards high-quality development. With a value-based competitive landscape and an optimised global market layout, China’s PV industry will strengthen its position as a global leader, supporting the construction of the new power system and the dual carbon goal.

Scan the QR code to follow PVTIME official account on Wechat for latest news on PV+ES