PVTIME – JinkoSolar Holding Co., Ltd. (“JinkoSolar” or the “Company”) (NYSE: JKS), one of the largest and most innovative solar module manufacturers in the world, today announced its unaudited financial results for the first quarter ended March 31, 2020.

Strategic Business Updates

- Technological transformation towards high-efficiency portfolio of products now complete – mono wafer production capacity has been fully ramped up to 18GW in April 2020.

- Sale of two solar power plants with a combined capacity of 155MW in Mexico was closed in March 2020, allowing for the deleveraging of the Company’s balance sheet by US$121.3 million.

- Leading the industry towards grid parity with the launch of 2020 flagship Tiger Pro module series.

- Reaffirm 2020 full-year shipment guidance and capacity expansion plan despite a decrease in global demand.

- Pandemic accelerating removal of outdated capacity in the market providing an opportunity for leading industry players to expand market share.

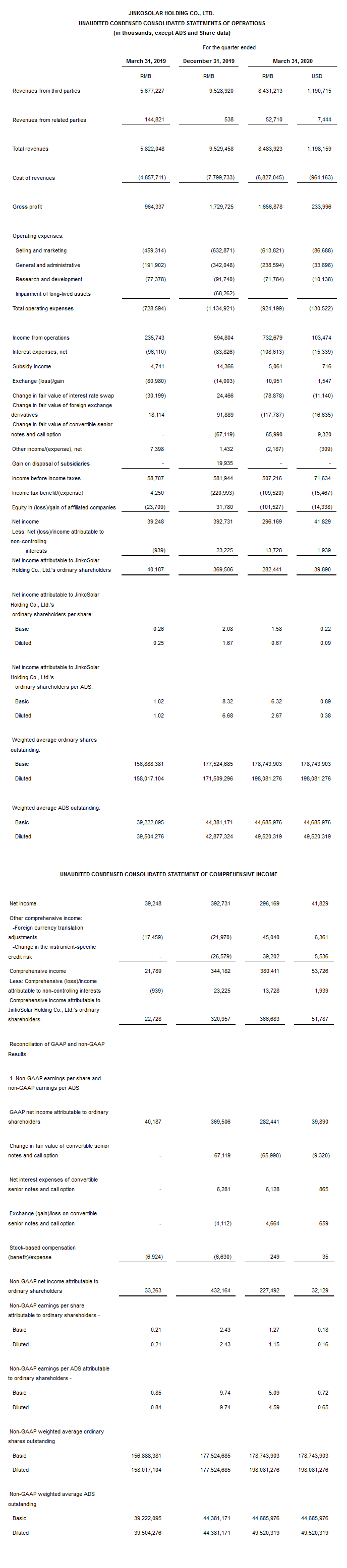

First Quarter 2020 Operational and Financial Highlights

- Total solar module shipments were 3,411 megawatts (“MW”), within JinkoSolar’s guidance range of 3.4 GW to 3.7 GW, a decrease of 24.8% from 4,538 MW in the fourth quarter of 2019 and an increase of 12.3% from 3,037 MW in the first quarter of 2019.

- Total revenues were RMB8.48 billion (US$1.20 billion). Excluding the impact from the disposal of the two solar power plants in Mexico, revenues were RMB7.29 billion (US$1.03 billion) and within JinkoSolar’s guidance range of US$1.00 billion to US$1.08 billion; a decrease of 23.5% from the fourth quarter of 2019 and an increase of 25.1% from the first quarter of 2019.

- Gross margin was 19.5%. Excluding the impact from the disposal of two solar power plants in Mexico, gross margin was 19.7%, within JinkoSolar’s guidance range of 19.0% to 21.0%, compared with 18.2% in the fourth quarter of 2019 and 16.6% in the first quarter of 2019.

- Income from operations was RMB732.7 million (US$103.5 million). Excluding the impact from the disposal of two solar power plants in Mexico, income from operations was RMB519.5 million (US$73.4 million), compared with RMB594.8 million in the fourth quarter of 2019 and RMB235.7 million in the first quarter of 2019.

- Net income attributable to the Company’s ordinary shareholders was RMB282.4 million (US$39.9 million) in the first quarter of 2020, compared with RMB369.5 million in the fourth quarter of 2019 and RMB40.2 million in the first quarter of 2019.

- Diluted earnings per American depositary share (“ADS”) were RMB2.67 (US$0.38) in the first quarter of 2020.

- Non-GAAP net income attributable to the Company’s ordinary shareholders in the first quarter of 2020 was RMB227.5 million (US$32.1million), compared with RMB432.2 million in the fourth quarter of 2019 and RMB33.3 million in the first quarter of 2019.

- Non-GAAP basic and diluted earnings per ADS were RMB5.09 (US$0.72) and RMB4.59 (US$0.65), respectively, in the first quarter of 2020, compared with RMB9.74 for both in the fourth quarter of 2019 and RMB0.85 and RMB0.84, respectively, in the first quarter of 2019.

Mr. Kangping Chen, JinkoSolar’s Chief Executive Officer commented, “JinkoSolar continued to outperform during the quarter despite a very challenging global operating environment. Total solar module shipments, total revenue and gross margin were all within our guidance range for the quarter. Module shipments hit a record high 3,411MW during the quarter while total revenues were US$1.03 billion and gross margin was 19.7% if you exclude the impact from the disposal of two solar power plants in Mexico. As one of the world’s leading solar module manufacturers, we have leveraged our deep experience to lead the industry through the pandemic which has allowed us to not only further expand our market share but also create technical standards and develop technological breakthroughs for a variety of products. Our order book for the second quarter and the rest of the year remains strong, and our guidance for total shipments for the full year 2020 remains unchanged at 18 to 20 GW.”

“While we expect global installations to fall by around 25% from last year due to the pandemic, we see a number of growth opportunities in the near-term as the market consolidates. Governments around the world have refocused their attention on energy security and localization, especially after the COVID-19 outbreak. As solar energy continues to race towards grid parity, we expect more countries to implement policies that support solar energy in the post-pandemic era, and at the same time, remove outdated energy capacity, reduce the levelized cost of energy for solar, and accelerate the application of new technologies to drive the deeper penetration of solar energy globally. Smaller, less-competitive manufacturers will gradually exit the market, leaving more opportunities for a few key players to expand their market share worldwide.”

“Technology remains central to strengthening our competitive edge in the market. We recently launched a new Tiger Pro series module with a maximum power output of 580W. The pandemic has actually accelerated the adoption of high-efficiency premium products by downstream partners which is allowing the industry to transition into the 500W ultra-high efficiency era earlier than expected. We continue to lead the industry by developing and launching innovative premium products, leveraging our highly-skilled R&D team, industry-leading research platform and expanding capacity to bring mass-produced cutting-edge products to market.”

“We continue to face a variety of challenges so far during the second quarter of 2020. Despite falling raw material prices, there has been a significant decline in overall global demand, and varying degrees of logistics and project delays in overseas markets. Our teams have been working hard to coordinate production, logistics and sales, while optimizing inventory levels. We continue to arrange shipments of personal protective equipment to our Malaysian and U.S. production facilities and ensure we are doing all we can to care for our employees, clients, suppliers and other business partners during this challenging time.”

First Quarter 2020 Financial Results

Total Revenues

Total revenues in the first quarter of 2020 were RMB8.48 billion (US$1.20 billion). In March 2020, the Company disposed of two solar power plants in Mexico with a combined capacity of 155 MW to an independent third party, and recognized revenue and cost of sales in the amount of RMB1.20 billion (US$169.1 million) and RMB979.7 million (US$138.4 million), respectively. Revenue from the disposal is composed of RMB284.4 million (US$ 40.1 million) in cash consideration and RMB1.29 billion (US$ 182.2 million) in non-cash consideration related to the buyer assuming project debt which was offset by settlement of loan receivables due from the solar power plants in the amount of RMB 376.9 million (US$ 53.2 million). Excluding the impact from the disposal of two solar power plants in Mexico, revenue was RMB7.29 billion (US$1.03 billion), a decrease of 23.5% from RMB9.53 billion in the fourth quarter of 2019 and an increase of 25.1% from RMB5.82 billion in the first quarter of 2019. The sequential decrease was mainly attributable to a decrease in the shipment of solar modules partially due to the delay of module shipments caused by the outbreak of COVID-19. The year-over-year increase was mainly attributable to the increase in shipment of solar modules.

Gross Profit and Gross Margin

Gross profit in the first quarter of 2020 was RMB1.66 billion (US$234.0 million). Excluding the impact from the disposal of two solar power plants in Mexico, gross profit was RMB1.44 billion (US$203.2 million), compared with RMB1.73 billion in the fourth quarter of 2019 and RMB964.3 million in the first quarter of 2019. The sequential decrease was mainly attributable to a decrease in the shipment of solar modules. The year-over-year increase was mainly attributable to (i) an increase in the shipment of solar modules, (ii) an increase in self-produced production volume that is increasingly shifting toward integrated mono-based high-efficiency products capacity, and (iii) the continued reduction of integrated production costs resulting from the Company’s industry-leading integrated cost structure.

Gross margin was 19.5% in the first quarter of 2020. Excluding the impact from the disposal of two solar power plants in Mexico, gross margin was 19.7%, compared with 18.2% in the fourth quarter of 2019 and 16.6% in the first quarter of 2019. The sequential and year-over-year increases were mainly attributable to (i) an increase in self-produced production volume by increasing shift toward integrated mono-based high-efficiency products capacity, and (ii) the continued reduction of integrated production costs resulting from the Company’s industry-leading integrated cost structure.

Income from Operations and Operating Margin

Income from operations in the first quarter of 2020 was RMB732.7 million (US$103.5 million), including RMB213.2 million (US$30.1 million) from the disposal of two solar power plants in Mexico, compared with RMB594.8 million in the fourth quarter of 2019 and RMB235.7 million in the first quarter of 2019. Operating margin was 8.6% in the first quarter of 2020. Excluding the impact from the disposal of two solar power plants in Mexico, operating margin was 7.1%, compared with 6.2% in the fourth quarter of 2019 and 4.0% in the first quarter of 2019.

Total operating expenses in the first quarter of 2020 were RMB924.2 million (US$130.5 million) including RMB4.8 million (US$ 0.7 million) from the disposal of two solar power plants in Mexico, a decrease of 18.6% from RMB1.13 billion in the fourth quarter of 2019 and an increase of 26.8% from RMB728.6 million in the first quarter of 2019. The sequential decease was mainly due to (i) a decrease in shipping cost resulting from a decrease in solar module shipments, (ii) a decrease of impairment loss on property, plant and equipment, and (iii) a reversal of a previous bad debt provision upon cash receipt of RMB52.5 million (USD7.4 million) based on final judgement for the lawsuits with Wuxi Zhongcai. The year-over-year increase was mainly due to an increase in shipping costs.

Total operating expenses accounted for 10.9% of total revenues in the first quarter of 2020. Excluding the impact from the disposal of two solar power plants in Mexico, operating expense accounted for 12.6% of revenues, compared to 11.9% in the fourth quarter of 2019 and 12.5% in the first quarter of 2019. The sequential increase was primarily due to an increase in shipping costs as a percentage of total revenue associated with a higher percentage of shipments to overseas market in the first quarter of 2020.

Interest Expense, Net

Net interest expense in the first quarter of 2020 was RMB108.6 million (US$15.3 million), an increase of 29.6% from RMB83.8 million in the fourth quarter of 2019 and an increase of 13.0% from RMB96.1 million in the first quarter of 2019. The sequential increase was mainly due to an increase in interest expense associated with discounted notes receivables in the first quarter of 2020. The year-over-year increase was mainly due to (i) an increase in borrowings, (ii) the cessation of interest capitalization on certain completed solar projects, and (iii) issuance of additional convertible senior notes in May 2019.

Exchange (Loss)/Gain and Change in Fair Value of Foreign Exchange Derivatives

The Company recorded a net exchange loss (including change in fair value of foreign exchange derivatives) of RMB106.8 million (US$15.1 million) in the first quarter of 2020, compared to a net exchange gain of RMB77.9 million in the fourth quarter of 2019 and a net exchange loss of RMB62.9 million in the first quarter of 2019. With the rapid increase in overseas orders, the Company increased its foreign currency hedge ratio to hedge against anticipated cash flow denominated in U.S. dollars over the next six months. The Company recorded a loss arising from foreign exchange forward contracts associated with the appreciation of the U.S. dollars against the RMB in the first quarter of 2020.

Change in Fair Value of Interest Rate Swap

The Company entered into Interest Rate Swap agreements with several banks for the purpose of reducing interest rate risk exposure associated with the Company’s overseas solar power projects. The Company recorded a loss arising from change in fair value of interest rate swap of RMB78.9 million (US$11.1 million) in the first quarter of 2020, compared to a gain of RMB24.5 million in the fourth quarter of 2019. The loss was primarily due to a decrease in long-term interest rates in the first quarter of 2020. The Company did not elect to use hedge accounting for any of its derivatives.

Change in Fair Value of Convertible Senior Notes and Call Option

The Company issued US$85.0 million of 4.5% convertible senior notes due 2024 (the “Notes”) in May 2019 and has elected to measure the Notes at fair value. The Company recognized a gain from a change in fair value of the Notes of RMB166.2 million (US$23.5 million) in the first quarter of 2020, compared to a loss of RMB152.7 million in the fourth quarter of 2019. The change was primarily due to a decrease in the Company’s stock price in the first quarter of 2020.

Concurrent with the issuance of the Notes in May 2019, the Company entered into a call option transaction with an affiliate of Credit Suisse Securities (USA) LLC. The Company accounted for the call option transaction as freestanding derivative assets in its consolidated balance sheets, which is marked to market during each reporting period. The Company recorded a loss from a change in fair value of the call option of RMB100.2 million (US$14.1 million) in the first quarter of 2020, compared to a gain of RMB85.6 million in the fourth quarter of 2019. The change was primarily due to a decrease in the Company’s stock price in the first quarter of 2020.

Equity in (Loss)/Gain of Affiliated Companies

The Company indirectly holds a 20% equity interest in Sweihan PV Power Company P.J.S.C, a developer and operator of solar power projects in Dubai, and accounts for its investment using the equity method. The Company also holds a 30% equity interest in Jiangsu Jinko-Tiansheng Co., Ltd, which processes and assembles PV modules as an OEM manufacturer, and accounts for its investments using the equity method. The Company recorded equity in loss of affiliated companies of RMB101.5 million (US$14.3 million) in the first quarter of 2020, compared with a gain of RMB31.8 million in the fourth quarter of 2019 and a loss of RMB23.7 million in the first quarter of 2019. The loss primarily arose from change in fair value of interest rate swap agreements purchased by Sweihan PV Power Company P.J.S.C. due to a decrease in long-term interest rates in the first quarter of 2020. Hedge accounting was not applied for the derivative.

Income Tax (Expenses)/Benefit

The Company recorded an income tax expense of RMB109.5 million (US$15.5 million) in the first quarter of 2020, compared with an income tax expense of RMB221.0 million in the fourth quarter of 2019 and an income tax benefit of RMB4.3 million in the first quarter of 2019. The sequential decrease was mainly because (i) a JinkoSolar’s subsidiary turned a profit in 2019 and utilized corresponding deferred tax assets recognized for tax loss carryforward, and (ii) JinkoSolar’s subsidiaries in U.S. with higher income tax rate generated higher profits in the fourth quarter of 2019 compared to the first quarter of 2020.

Net Income and Earnings per Share

Net income attributable to the Company’s ordinary shareholders was RMB282.4 million (US$39.9 million) in the first quarter of 2020, compared with RMB369.5 million in the fourth quarter of 2019 and RMB40.2 million in the first quarter of 2019.

Basic and diluted earnings per ordinary share were RMB1.58 (US$0.22) and RMB0.67 (US$0.09), respectively, during the first quarter of 2020. This translates into basic and diluted earnings per ADS of RMB6.32 (US$0.89) and RMB2.67 (US$0.38), respectively.

Non-GAAP net income attributable to the Company’s ordinary shareholders in the first quarter of 2020 was RMB227.5 million (US$32.1 million), compared with RMB432.2 million in the fourth quarter of 2019 and RMB33.3 million in the first quarter of 2019.

Non-GAAP basic and diluted earnings per ordinary share were RMB1.27 (US$0.18) and RMB1.15 (US$0.16), respectively, during the first quarter of 2020. This translates into non-GAAP basic and diluted earnings per ADS of RMB5.09 (US$0.72) and RMB4.59 (US$0.65), respectively.

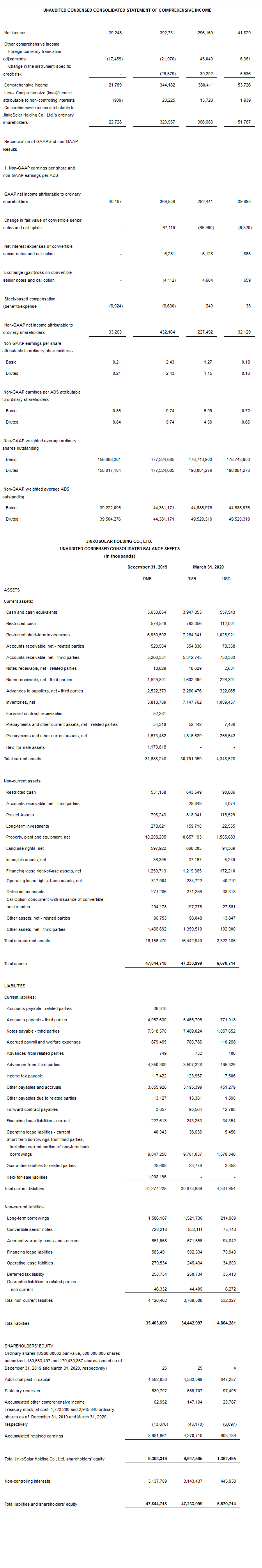

Financial Position

As of March 31, 2020, the Company had RMB4.74 billion (US$669.5 million) in cash and cash equivalents and restricted cash, compared with RMB6.23 billion as of December 31, 2019.

As of March 31, 2020, the Company’s accounts receivables due from third parties were RMB5.31 billion (US$750.3 million), compared with RMB5.27 billion as of December 31, 2019.

As of March 31, 2020, the Company’s inventories were RMB7.15 billion (US$1.01 billion), compared with RMB5.82 billion as of December 31, 2019.

As of March 31, 2020, the Company’s total interest-bearing debts were RMB12.79 billion (US$1.81 billion), of which RMB1.15 billion (US$162.3 million) was related to the Company’s overseas downstream solar projects, compared with RMB13.41 billion, of which RMB2.05 billion was related to the Company’s overseas downstream solar projects as of December 31, 2019. The decrease of interest-bearing debts was mainly due to the disposal of two solar power plants in Mexico.

First Quarter 2020 Operational Highlights

Solar Module Shipments

Total solar module shipments in the first quarter of 2020 were 3,411 MW.

Solar Products Production Capacity

As of March 31, 2020, the Company’s in-house annual mono wafer, solar cell and solar module production capacity was 17.5 GW, [1]10.6 GW (9.8 GW for PERC cells and 800 MW for N type cells) and 16 GW, respectively.

| Note 1: |

| In addition to the mono wafer, our multi wafer production capacity was 3.5 GW as of March 31, 2020. |

Operations and Business Outlook

The guidance for total module shipment and capacity expansion of the Company remain unchanged. The Company expects that the COVID-19 outbreak will lead to a significant decrease in global demand, causing the decrease in the market price of solar modules.

Second Quarter and Full Year 2020 Guidance

The Company’s business outlook is based on management’s current views and estimates with respect to market conditions, production capacity, the Company’s order book and the global economic environment. This outlook is subject to uncertainty on final customer demand and sale schedules. Management’s views and estimates are subject to change without notice.

For the second quarter of 2020, the Company expects total solar module shipments to be in the range of 4.2 GW to 4.5 GW. Total revenue for the second quarter is expected to be in the range of US$1.10 billion to US$1.18 billion. Gross margin for the first quarter is expected to be between 16% and 18%.

For full year 2020, the Company estimates total solar module shipments to be in the range of 18 GW to 20 GW.

Solar Products Production Capacity

JinkoSolar expects its annual mono wafer, solar cell and solar module production capacity to reach 20.0 GW, 11.0 GW (including 900 MW N-type cells) and 25.0 GW, respectively, by the end of 2020.

Recent Business Developments

- In February 2020, JinkoSolar was awarded the “Top Brand PV Europe Seal 2020” by EuPD Research, an internationally recognized research institute, for the second consecutive year.

- In March 2020, JinkoSolar’s Tiger module hit 1GW in orders during the first three months after its launch.

- In March 2020, JinkoSolar’s new N-type all black solar panel specifically developed for home installation generate a maximum output of 405 Wp and hit a 21.22% efficiency, enabling homeowners to fit more power capacity on rooftops than ever before.

- In March 2020, JinkoSolar’s Board of Directors approved a share repurchase program which authorizes the Company to repurchase up to US$100 million of its ordinary shares represented by American depositary shares within twelve months.

- In March 2020, Mr. Xiande Li, Chairman of JinkoSolar’s Board of Directors, completed purchase of 200,000 JinkoSolar’s American depositary shares.

- In March 2020, JinkoSolar donated one million face masks and other protective equipment items to several countries severely affected by COVID-19 including Italy, Spain, Germany, France, Britain, Switzerland, South Korea, the Netherlands, Austria, Belgium, Turkey, Portugal and Norway.

- In April 2020, Jinko Solar Australia Holdings Co. Pty Ltd, a subsidiary of JinkoSolar, signed a one-year AUD37 million credit line agreement with the National Australia Bank.

- In April 2020, JinkoSolar announced favorable developments in patent litigation brought by Hanwha Q CELLS.

- In May 2020, JinkoSolar officially launched the 2020 flagship Tiger Pro module series.

- In May 2020, JinkoSolar was ranked as a Top Performer for the sixth consecutive year in the 2020 PV Module Reliability Scorecard published by PV Evolution Labs in partnership with DNV GL.

Conference Call Information

JinkoSolar’s management will host an earnings conference call on Monday, June 15, 2020 at 8:00 a.m. U.S. Eastern Time (8:00 p.m. Beijing / Hong Kong the same day).

Dial-in details for the earnings conference call are as follows:

| Hong Kong / International: | +852 3027 6500 |

| U.S. Toll Free: | +1 855-824-5644 |

| Passcode: | 55108006# |

Please dial in 10 minutes before the call is scheduled to begin and provide the passcode to join the call.

A telephone replay of the call will be available 2 hours after the conclusion of the conference call through 23:59 U.S. Eastern Time, June 22, 2020. The dial-in details for the replay are as follows:

| International: | +61 2 8325 2405 |

| U.S.: | +1 646 982 0473 |

| Passcode: | 319334664# |

Additionally, a live and archived webcast of the conference call will be available on the Investor Relations section of JinkoSolar’s website at www.jinkosolar.com.