- Net sales of $629 million

- Net income per share of $0.77

- Cash, cash equivalents, restricted cash, and marketable securities of $2.1 billion

- YTD net bookings of 9.0 GW DC ; 4.1 GW DC since prior earnings call

- Started site preparation for previously announced 3.3 GW DC factory in Ohio

- Announced additional 3.3 GW DC manufacturing expansion in India, contingent upon permitting and pending approval of governmental incentives that are satisfactory to First Solar

- Nameplate manufacturing capacity expected to increase to 16 GW DC in 2024

- World record CdTe module efficiency validated

- Earnings guidance lowered primarily due to freight costs

PVTIME – First Solar, Inc. (Nasdaq: FSLR) today announced financial results for the second quarter ended June 30, 2021.

“I would like to thank our associates for their passion, continued excellence, and their many achievements in the second quarter.” said Mark Widmar, CEO of First Solar. “Operationally, we started site preparation for the new factory in Ohio and today announced additional capacity expansion in India. These factories of the future are expected to produce our next-generation module with a fleet-leading highest efficiency and wattage, at a lower cost per watt produced and environmental footprint. Commercially, market demand for our cadmium telluride, or CdTe, technology is at a record level, with year-to-date bookings of 9 GWDC. From a technology standpoint, we recently validated a world record CdTe module. This momentum we have cultivated, paired with an increasingly favorable policy environment, presents a compelling growth opportunity in the near-to mid-term.”

Net sales for the second quarter were $629 million, a decrease of $174 million from the prior quarter, primarily due to the sale of the Sun Streams 2, 4, and 5 projects in the prior quarter, which were partially offset by an increase in module segment revenue and revenue related to a settlement agreement for a legacy systems project.

Operating income for the second quarter was $110 million, compared to $252 million in the prior quarter. Second quarter operating income included depreciation and amortization of $66 million, revenue and gross margin related to the aforementioned settlement agreement of $65 million, $9 million related to underutilization and production start-up, and share-based compensation of $5 million.

Net income per diluted share for the second quarter was $0.77, compared to $1.96 in the prior quarter.

Cash, cash equivalents, restricted cash, and marketable securities at the end of the second quarter totaled $2.1 billion, an increase of $255 million from the prior quarter. This increase was primarily due to proceeds from the sale of our U.S. project development business and operating cash flows during the second quarter, which were partially offset by capital expenditures and operating expenses.

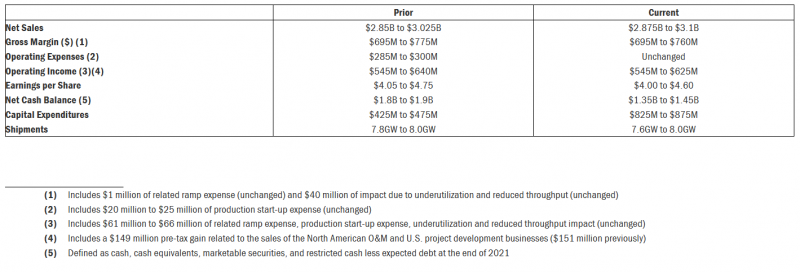

2021 guidance has been updated as follows: