Since their introduction in 2019, the 166mm and 210mm wafers pushed by two monocrystalline giants LONGi and Zhonghuan Semiconductor, respectively, have attracted much attention. Investments in large-size wafer products continue as solar technology giants including Tongwei, JA Solar, LONGi and Aikosolar have all announced production expansion plans in 2020.

Although being heavily promoted by advocates, the 166mm and 210mm products have been getting lukewarm reception from the market so far. Downstream solar project enterprises are prudent in product selection, and module manufacturers are also cautious when it comes to upgrading their production lines. This in turn has limited the large-scale application of 166mm and 210mm products thus far. It will take time for the new large-sized products to penetrate the market.

Orders for modules with 158.75mm cells are booming

Production capacity has been gradually restored as the Chinese authorities work hard to get the coronavirus outbreak under control while solar companies are speeding up the delivery of modules in order to fulfill orders.

“In the first half of 2020, the majority of the orders received are for the 158.75mm series.” Marketing director of Risen Energy, Zhuang Yinghong revealed. Market survey(just 1 or surveys?) indicated that leading module manufacturers including Jinko Solar, JA Solar, Trina Solar, and Risen Energy, are the key suppliers of 158.75mm products in the first half of 2020, which validates the popularity of 158.75mm sized products.

Compared with other larger-size 166mm and 210mm products, the 158.75mm product is relatively low-profile, but has significant competitive advantages in the market.

The two differentiating factors that put it in a favorable competitive position are its high cost to performance and low production line retrofitting costs, which power station owners and manufacturing enterprises care about.

An anonymous member of an electric power design institute commented, “Power station owners actually do not care much about the size of the modules. They are more concerned about the installed capacity and economic benefits. Their module choices are not influenced by the market or investors’ pursuit for new technologies. It is the actual benefits of power stations that matters most to them.”

In terms of cost, when comparing modules with 156.75mm cells and those with 158.75mm cells, the “158.75mm modules” are manufactured with a slight higher wafer cost, but demonstrates decreases in both cell and module costs.

| Process | The cost of 158.75 compared with 156.7(%) |

| Wafer cost (Yuan/Watt) | 0.40% |

| Cell cost (Yuan/Watt) | -1.20% |

| Module cost (Yuan/Watt) | -1.50% |

| Overall cost (Yuan/Watt) | -1% |

The high compatibility of 158.75mm modules with current production lines makes the modules more advantageous by enabling them to be superimposed with half-cell and multi-busbar technologies. Take the application simulation of a regular mono PERC 385Wp module and a JA Solar 9BB half-cell 410Wp module as an example, the 9BB half-cell module greatly raises the power output, reduces the number of modules needed to build a 50MW project from 129,900 to 121,900 (decreasing the occupied area by 3.25%), while lowering the installation costs and BOS costs by 6.40% and 4.95%, respectively.

Moreover, the main changes of the 158.75mm cell production lines are in their automation equipment and fixtures. In term of fixtures, while EVA, back sheet and glass sizes need to be increased, other parts remain unchanged. Overall, the retrofitting costs of switching from 156.75mm to 158.75mm products have the lowest links of wafer, cell, and module costs than transitioning to 166mm and 210mm products, which is another driving factor as to why enterprises are actively switching production lines to manufacture 158.75mm modules.

According to PVInfoLink statistics, most enterprises have basically completed the retrofitting of production lines for 158.75mm module production, and 158.75mm production lines occupy as much as 89% of the market.

Large-scale supply of 166mm and 210mm modules is still some ways away

For 166mm and 210mm products, matching design on the systems’ side is particularly important. “There are a few systems supporting the application of “166mm modules” (modules with 166mm cells), but there are no systems designed for “210mm modules” (modules with 210mm cells) yet.” The aforementioned electric power design institute member said that the lack of matching devices on the systems’ side brings resistance for the large-scale application and promotion of the large-size products.

In terms of the production line, when compared with the 158.75mm products, the upgrading progress is costly and customer preference of the 166mm and 210mm is unclear at this time. This makes it difficult for those two larger sizes to overtake 158.75mm in the short-term.

In order to mass produce 166mm cells, much investment,time,and the purchasing of tubular PERC cell coating equipment and other auxiliary equipment is needed to achieve automation renovation. Specifically, module production welding, stitch welding, laminating, and framing machines, as well as the assembly line would all need to be upgraded, and would result in a 20% loss if 156.75mm production lines were to be upgraded. In addition, manufacturers who have just completed the conversion to 158.75mm products would not switch to larger sizes if the market demand is particularly enticing.

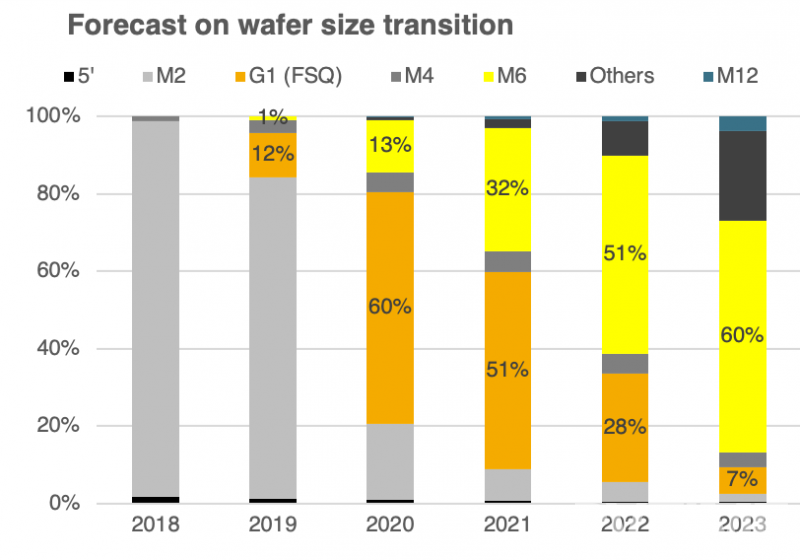

For modules with 210mm cells, all machines would have to be adjusted, and new production lines will need to be built. According to cell producers, it usually takes 10-12 months to build a new cell production line if everything goes well. As such, despite the enthusiasm for 166mm and 210mm products on the market, it will take some time to achieve mass production. According to PVInfoLink, G1(158.75mm) wafers will account for 60% and M6 (166mm) for 13% of the market in 2020 but will change to 7% (M1) and 60% (M6) in 2023.

In March 2020, cell manufacturing giant Tongwei Solar lowered the price of mono PERC 166mm cells to 1 yuan/W, the same as mono PERC 158.75mm cells, which may stimulate the demand for 166mm cells. There is also speculation in the industry that since the main buyer of 166mm cell is LONGi, this price change may be related to the low current demand for 166mm products.

It is very clear that 166mm and 210mm will be the future. In the first half of this year, cell manufacturers Tongwei Solar and Aiko Solar both upgraded their production lines to be compatible with 210mm cells, while Risen Energy and Trina Solar have also put the mass production of the “210mm modules” on their technology roadmaps. Additionally, JA Solar’s “10GW high-efficiency cell +10GW high-efficiency module” project in Yiwu will also be compatible with 210mm products. All major module manufacturers are preparing for the adoption of large-size products.

Since the design of “210mm module” is quite different from that of regular modules, and customer acceptance is not yet clear, the 158.75mm products will continue to be the product of choice in the market for some time with its low production line retrofitting costs and high cost to performance advantages, and its status will not be easily shaken.